Startups in MENA

The significant changes in the market are blamed on a slowdown in global economic activity and the subsequent impact on investor sentiment. This is also a result of the outbreak of war in Ukraine and the subsequent effects of the banking crisis in Silicon Valley.

At the same time, the Eid and Easter breaks played a role in the sharp decline in funding for startups in the Mena region. While many investors were encouraged by the record $247 million raised in March, the subsequent holidays caused a sharp slowdown in activity.

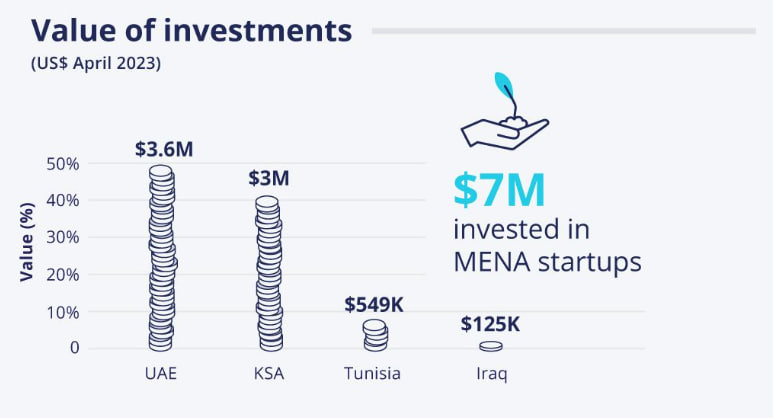

News that startups in the Middle East and North Africa raised just over $7 million in April 2023 is troubling. While the region saw strong investment growth in 2020 and 2021, the war in Ukraine and the banking crisis in Silicon Valley seem to have had a significant impact on investor confidence.

The slowdown in startup funding was particularly sharp in April, with funds raised 97 percent less than in March and 99 percent less than in April of the previous year.

In light of the current challenges, it’s important for investors to focus on projects that can generate long-term returns. It is also important to support existing startups and entrepreneurs in the region, as they are the ones that will suffer the most from the slowdown in investment growth. With the right support and guidance, these startups can thrive and be successful in the long term.