In today’s world, investing has broken free from its enigmatic aura and is now within reach for everyone. With ‘suser-friendly platform and a wealth of educational resources, the journey from a cautious saver to a confident investor has never been smoother. If you’re intrigued by the idea of watching your money work for you, it’s time to delve into the exciting world of investing. In this article, we’ll unravel the mysteries of getting started, finding the right assets, and shifting your mindset from consumer to investor. So, let’s dive in and discover how to embark on your investing journey, even if you’re just starting out.

Understanding the Basics

Before you dive headfirst into the world of investments, it’s essential to grasp the fundamental concepts that underpin trading exchanges. While we won’t turn this article into a textbook, familiarizing yourself with key terms is crucial to your success. Ever wondered about books to kick-start your investment journey? Curious about building a financial cushion or harnessing the power of compound interest? These are all stepping stones toward becoming an astute investor. As the saying goes, compound interest is the eighth wonder of the world; understanding it can be the difference between working for the banks or having interest work for you. So, consider exploring these resources to lay a solid foundation for your investment venture.

Mapping Your Risk Profile

Investing isn’t a one-size-fits-all endeavor; it’s about finding the right balance between risk and reward. Picture your investment journey as a road trip—you’re the driver, and your risk profile is the map guiding your route. Government bonds might be the smoothest highway with minimal risk, while stocks offer a more adventurous, albeit riskier, trail. Your risk profile determines which path suits you best. Crafting a diversified portfolio is akin to packing your bags with a variety of essentials. Stocks, real estate, and gold can each play a role in your investment mix, ensuring you’re prepared for different terrains.

Choosing Your Investment Horizon

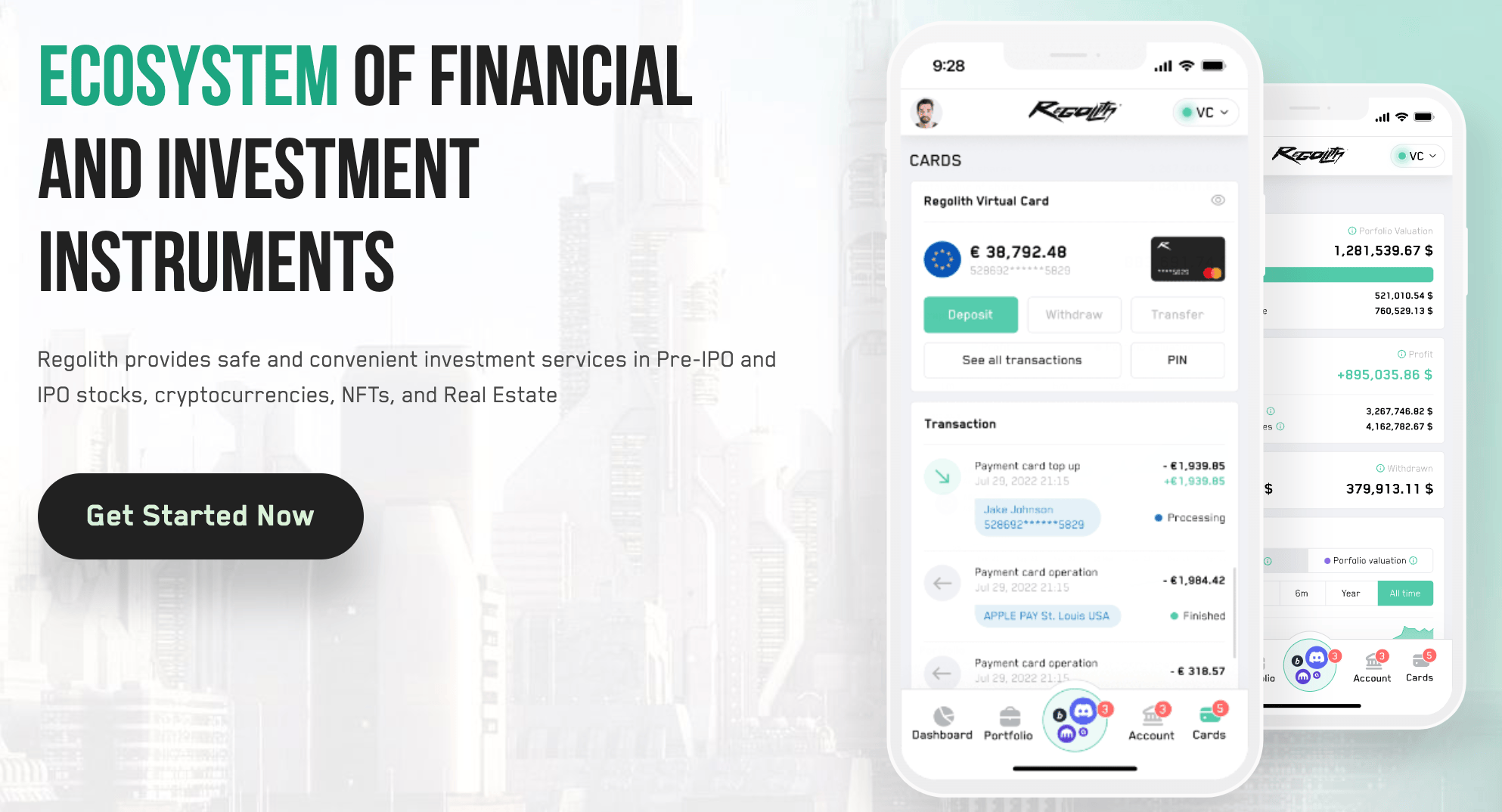

Imagine investing as planting seeds; some flourish within a single season, while others bear fruit over the years. Similarly, your investment horizon dictates how long you’re willing to wait for your assets to grow. Do you fancy day trading, where decisions need to be split-second? Or are you inclined towards a longer-term approach, sowing your investments and letting them blossom over several years? If you prefer a hands-off approach, you might consider entrusting your funds to professionals, like the , which offers a diverse range of investment options: Pre-IPO and IPO stocks, cryptocurrencies, NFTs, Real Estate and etc…

Conquering the Fear Factor

Fear of failure can paralyze even the boldest of dreams. The same holds true for investing. Overcoming this fear requires a multi-pronged approach. Building a financial cushion — setting aside a safety net — gives you the confidence to weather market fluctuations. Remember, investing is a mental game; when your financial cushion is in place, the fear of loss becomes less daunting. Starting small and monitoring your investments over time can help you acclimate to the ups and downs, gradually building your confidence.

Riding the Trends

Have you ever heard the phrase “follow the herd”? Well, in investing, sometimes it’s better to steer clear of the herd mentality. When everyone is buzzing about a particular investment, it might be a sign to proceed with caution. Trends can be fickle, and sometimes the best investments are the ones that aren’t grabbing headlines. Staying attuned to market trends while maintaining your individuality can set you on a path to more informed decisions.

Embracing the Learning Curve

Consider your first monetary loss not as a failure, but as a rite of passage. This is the crossroads where you make a conscious decision—to persist or retreat. It’s a moment that tests your resilience and adaptability. While seeking professional guidance is an option, remember that even experienced investors face setbacks. The key is to learn from these experiences, adjust your strategy, and soldier on.

The Power of Early Start

Time, they say, is money’s best friend. The earlier you begin investing, the more time your money has to grow and multiply. Even starting with modest amounts can set you on a trajectory toward significant capital growth. The investment landscape is like a fertile garden; the sooner you sow, the more bountiful your harvest.

In the ever-evolving world of finance, investing has transformed from an exclusive club into an accessible avenue for wealth creation. Armed with the right knowledge, a calculated risk profile, and a resilient mindset, you’re poised to navigate this exciting journey. Don’t let fear hold you back — embrace the learning curve, heed the wisdom of compound interest, and choose investments that align with your goals. Whether you opt for a daring expedition through the stock market or a more measured approach, like the , your journey begins with a single step. So, are you ready to take that step and shape your financial future? The path to wealth awaits — venture forth and make your mark on the world of investing!

if you fancy being aware more about investment and the company, look through the following articles:

From Concept to Reality: The Birth of Regolith.com

How to invest money in 2023. Lifehack from founder Regolith.com

Den Kerzheman: Best Entrepreneur in April 2023 by Crunch/Dubai Online Journal

Investment Advisors Near Me! Who’s in the Top 100 investment advisors of Dubai? Big online research of CVO Aleksei Dolgikh

Regolith.com or Republic: Unlocking Your Investment Potential. Why Regolith.com Stands Out in a Sea of Choices