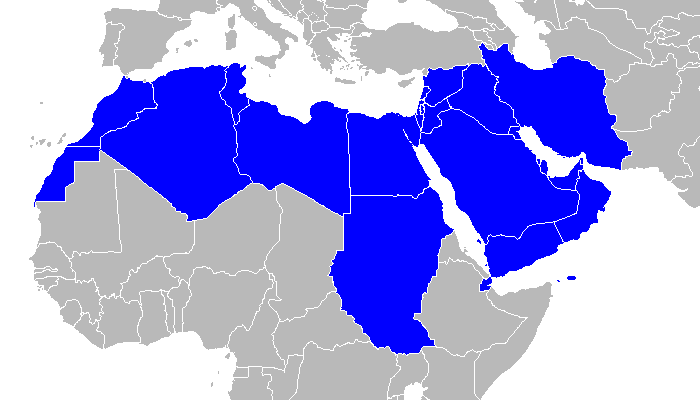

In recent years, the Middle East and North Africa (MENA) region has experienced a remarkable surge in innovation and entrepreneurial activity, largely attributed to the significant involvement of angel investors. These individuals play a pivotal role by providing not only essential funding but also mentorship and strategic guidance to nascent startups. This article explores the profiles and contributions of two prominent angel investors who are driving innovation and growth in the MENA region in 2023.

Perspective on Angel Investors in the MENA Entrepreneurial Ecosystem:

Angel investors play a vital and multifaceted role in the MENA region’s burgeoning entrepreneurial ecosystem:

Early-Stage Funding Catalysts: Angel investors fill a critical funding gap in the MENA startup scene, where traditional avenues might be limited. Their infusion of capital at the early stages empowers startups to develop products, establish teams, and achieve pivotal milestones.

Seeding Growth: By offering seed capital to nascent ventures, angel investors enable startups to cover initial operational costs, embark on product development, and conduct essential market testing. This early financial support is especially significant in a region where access to conventional funding can be constrained.

Expertise and Guidance: Angel investors bring not just financial resources but also invaluable industry insights, experiences, and networks. In a region where entrepreneurial expertise is evolving, their mentorship aids startups in making strategic decisions, forging valuable connections, and navigating local business dynamics.

Catalysts for Amplified Investments: Angel investments can act as catalysts for attracting subsequent funding from venture capital firms, corporate investors, and other institutional backers. The endorsement of reputable angel investors enhances startups’ credibility, attracting further investments and fostering investor confidence.

Fostering Innovation: Angel investors play a pivotal role in driving innovation and entrepreneurship in the MENA region. Their investments catalyze the development of novel technologies, products, and services that address local and global challenges, propelling economic growth and diversification.

Diversifying Investment Portfolios: For angel investors in the MENA region, backing startups offers opportunities for portfolio diversification beyond traditional assets. This diversification potential can lead to higher returns on investment while concurrently bolstering the local entrepreneurial landscape.

Stimulating Economic Growth: Startups supported by angel investors contribute to job creation and economic activity across the MENA region. As these startups expand, they generate employment opportunities, nurture skill development, and contribute to overall economic prosperity.

Shaping the Future of Innovation with Investors:

In 2023, the MENA region is undergoing a dynamic transformation fueled by visionary angel investors. Their unwavering commitment to early-stage investments, technological innovation, and social impact is reshaping the startup landscape across diverse sectors. As these investors continue to identify, support, and mentor promising entrepreneurs, the MENA region’s reputation as an innovation and entrepreneurship hub is poised for exponential growth, heralding a brighter future for the entire ecosystem.

Ofir Azury: Pioneering Technological Advancement and Social Impact Investments

I believe in people and strive to find the right combination of a great passionate team and a unique selling proposition.

At the helm of Technology Investments for Gandyr Investments, Ofir Azury occupies a crucial position in shaping the firm’s investment strategy within the technology sector. Gandyr Group, a distinguished private investment entity, boasts a diverse portfolio of over 30 companies, positioning itself as a formidable player in the regional investment landscape.

Azury’s investment focus centers on B2B software, Software as a Service (SaaS), Artificial Intelligence (AI), eCommerce, and digital health. His preference for early-stage investments underscores a deep commitment to nurturing innovative concepts and fostering their evolution into thriving enterprises. Azury excels in identifying startups that harness advanced technology and data analysis, providing them with essential financial backing and strategic guidance.

Beyond financial gains, Ofir Azury exhibits a genuine passion for social impact and sustainability. His dedication to the impact economy is evident through direct investments in impact-tech companies and sustainability infrastructure solutions. This encompasses ventures that leverage social bonds and offer financial products aligned with environmental, social, and governance (ESG) criteria.

Mehmet Selcuk Atici: Catalyzing Tech Startups in Eastern Europe and Turkey

A central figure in the MENA startup ecosystem, Mehmet Selcuk Atici, holds a pivotal role as an investor at Earlybird Digital East Fund. With substantial capital exceeding $300 million, this fund is dedicated to investing in ambitious technology companies originating from Eastern Europe and Turkey. Atici’s involvement positions him as a crucial link between emerging markets and the MENA region, facilitating cross-border collaborations and knowledge exchange.

Atici’s investment strategy revolves around identifying promising startups in Eastern Europe and Turkey and providing them with the necessary resources for scaling. His portfolio boasts impressive success stories, including UiPath, Peak, and Trendyol, all achieving multi-billion dollar valuations. Through nurturing these startups during their nascent stages, Atici significantly contributes to the maturation of a thriving tech ecosystem within the MENA region.

The strategic involvement of angel investors in the MENA entrepreneurial ecosystem is fostering a transformative wave of innovation and growth. Their multifaceted contributions are instrumental in propelling startups towards success, driving economic development, and positioning the region as a dynamic hub for innovation on the global stage.