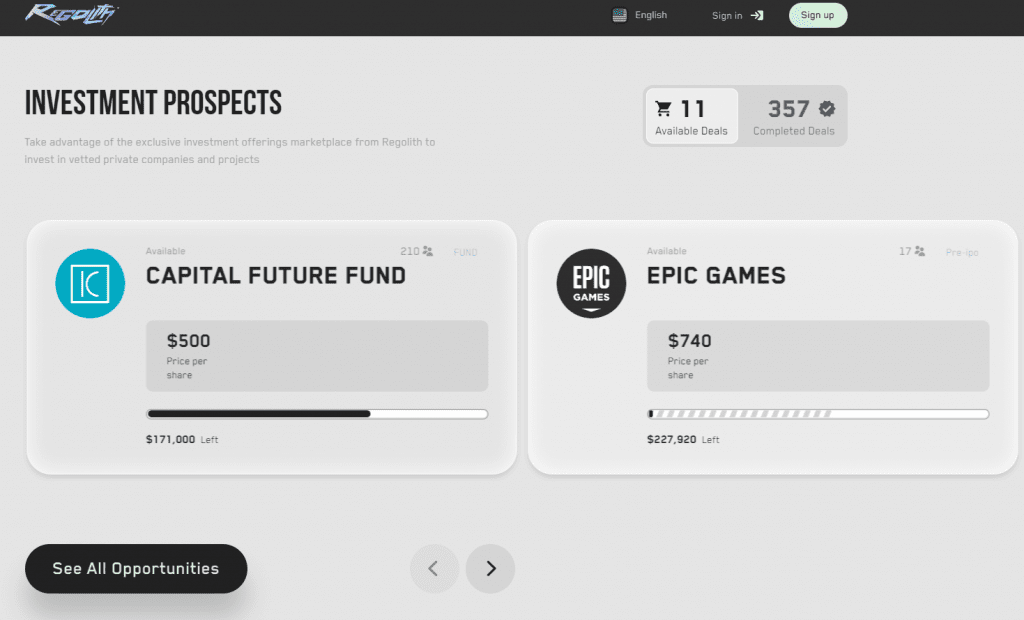

In the dynamic world of digital finance, stands out as a pioneering platform, offering a diverse array of investment tools designed to cater to the modern investor’s needs. These tools are not just financial instruments but gateways to potential wealth generation and portfolio diversification. Here, we delve into the essence of current product offerings, highlighting how they serve as pivotal investment tools in today’s market.

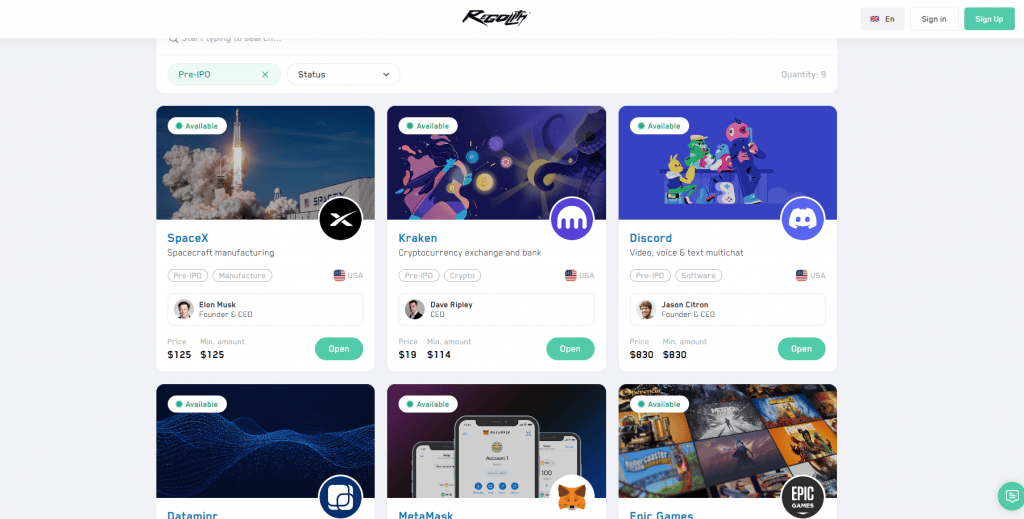

Pre-IPO Investment Opportunities

Regolith.com stands out in the digital investment arena with its unique Pre-IPO investment offerings. These represent a gateway for individual investors to engage with the growth narratives of companies before they go public. This investment segment is especially appealing for those aiming to potentially secure high returns by investing early in what could be tomorrow’s leading companies.

Investor Support: goes beyond merely providing access to Pre-IPO opportunities. The platform offers comprehensive support to investors, including educational resources to understand the nuances of Pre-IPO investing, updates on the progress of companies in the Pre-IPO phase, and guidance on portfolio diversification strategies. This support is crucial for investors navigating the complex and often unclear Pre-IPO market.

Community and Networking: Additionally, fosters a community of like-minded investors through forums and networking events. This community allows investors to share insights, learn from each other’s experiences, and stay informed about the latest trends and opportunities in the Pre-IPO space.

Advantages: The primary allure of Pre-IPO investments lies in their potential for substantial appreciation. Investors have the unique opportunity to buy shares at prices that may be significantly lower than their eventual public offering price. This early access can lead to outsized gains compared to traditional stock market investments. Furthermore, Pre-IPO investing allows individuals to diversify their portfolios with companies that are on the brink of major growth milestones but are not yet available on public exchanges.

The Pre-IPO product line features a remarkable case with Robinhood, a trailblazing trading platform that revolutionized the financial trading space. As an example, investors who accessed Robinhood’s shares during the Pre-IPO stage entered at a price of $15 per share. This strategic positioning allowed them to reap the benefits of the company’s subsequent growth, which, by the time of the IPO, resulted in the share value rising to $38. This substantial increase is a testament to the potential that Pre-IPO investments hold, offering investors the chance to capitalize on the early success of companies poised for significant market impact.

Regolith’s approach to Pre-IPO investments is designed to democratize access to these lucrative opportunities, once reserved for institutional investors or individuals with high net worth. By carefully selecting companies with strong growth potential and providing investors with detailed insights and analysis, Regolith aims to offer a path to significant returns by investing in tomorrow’s market leaders today.

Let’s break it down, what other investments are there?

IPO Investments

An Initial Public Offering (IPO), represents a pivotal moment for a private company, marking its transition into a public entity with shares traded on the stock market. This process allows companies to raise capital from public investors, supporting future growth, paying off debt, or allowing early investors and founders to realize part of their investment. For public investors, IPOs present an opportunity to invest in a company’s growth journey from its earliest stages, potentially reaping rewards as the company expands and its value increases in the public market.

Investing in IPOs allows investors to buy shares of a company at the moment it goes public. This strategic investment channel offers direct participation in a company’s initial offering to the stock market, enabling investors to be among the first to own shares in potentially transformative companies making their debut in the public market.

IPO investments can be particularly rewarding, providing investors with the opportunity for significant appreciation in share value shortly after the company goes public. As public interest and market valuation adjust post-IPO, early investors may see rapid growth in their investment value. Additionally, IPO investing allows individuals to diversify their portfolio with fresh market entrants, potentially capturing growth that aligns with emerging trends and innovations.

Investing in IPOs can be particularly strategic and, at times, immensely rewarding. For instance, consider investors who chose to invest in companies like Zoom and Beyond Meat as they launched their IPOs. The investment timing in these instances was critical; as both companies debuted on the stock market, they captured the attention and capital of the public, resulting in significant gains for early investors. Zoom, with its revolutionary video communications platform, which became even more relevant in the era of increased remote work and virtual meetings, offered returns of over 100% within just three months of its IPO. Likewise, Beyond Meat, a company that tapped into the burgeoning plant-based meat industry, generated an astounding 552% return within the same timeframe post-IPO. These examples underscore the potential windfalls that can come from IPO investments, highlighting the importance of market insight and the agility to capitalise on emergent trends at the right moment.

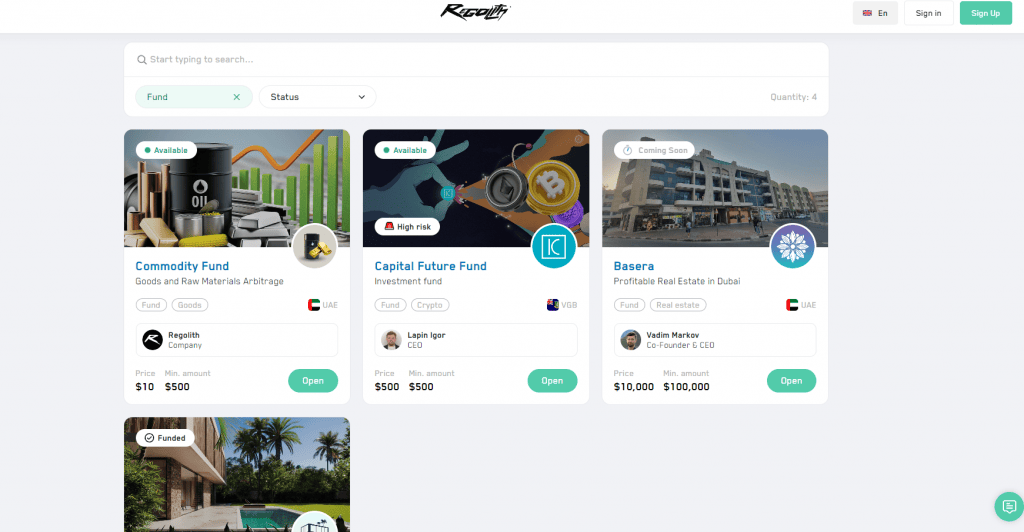

Commodity Fund

The Commodity Fund specializes in trading across various commodity groups, including but not limited to metals, energy resources, and agricultural products. This form of investment seeks to capitalise on the global demand and supply dynamics of essential commodities, exploiting price movements for potential gains. Commodity funds can offer investors exposure to physical goods markets, which have their own set of demand drivers separate from financial markets.

Investing in commodities can serve as an effective hedge against inflation, as commodities tend to retain value even when currencies weaken. Furthermore, commodities often move inversely to stocks and bonds, providing valuable portfolio diversification that can mitigate risk in turbulent market conditions. Additionally, the global nature of commodities markets offers exposure to worldwide economic trends, potentially opening up new avenues for growth.

A Commodity Fund for example CMDF exemplifies the potential for impressive returns within the commodities market. Posting a robust +77.1% return over just 14.5 months highlights the fund’s ability to capitalise on the commodities’ inherent price volatility. With an average monthly performance of +4.67%, investors could enjoy a steady accumulation of gains that can significantly outpace traditional savings and fixed-income instruments. Furthermore, the fund’s structure might allow for dividend payouts every 14 days, providing a regular income stream. This frequent payout could be particularly appealing to investors looking for more consistent cash flows from their investments. The performance of CMDF may reflect a deep understanding of commodity markets and the factors that drive them, such as global economic trends, supply and demand dynamics, and even geopolitical events. This expertise allows for strategic trades and positioning within the fund, which can harvest the growth potential of commodities while also navigating the risks. Such results underline the opportunity for investors to diversify their portfolio beyond stocks and bonds, tapping into the unique benefits that commodity investments have to offer.

To explore more about how you can leverage these opportunities, visit on the .

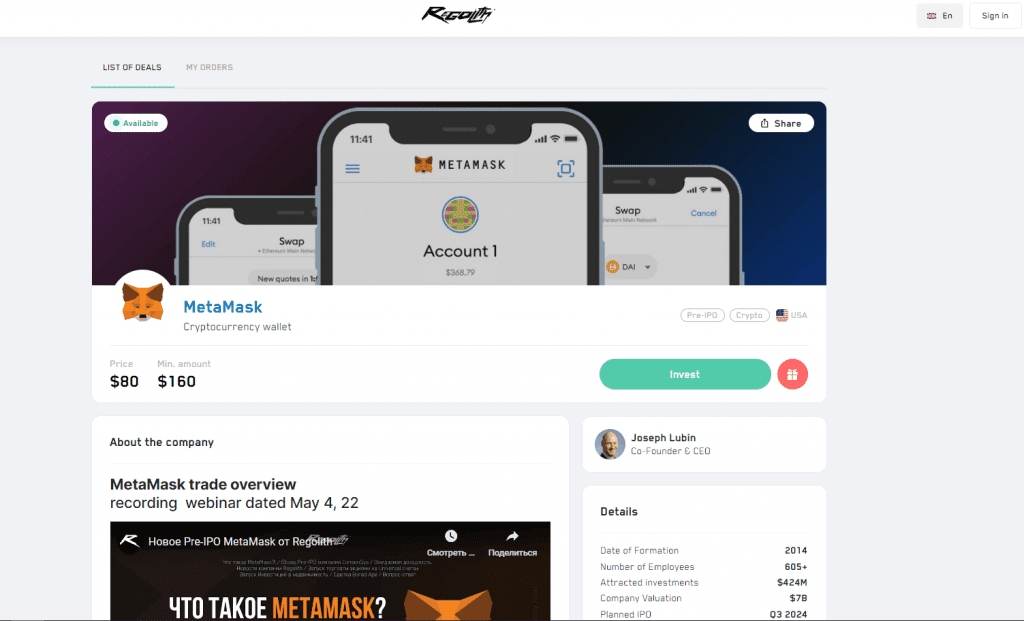

Crypto Investments

Crypto investments represent a foray into the burgeoning world of digital assets, including cryptocurrencies, tokens, and blockchain-based technologies. This investment class is designed for those looking to diversify into the rapidly evolving digital currency space, which stands at the forefront of financial technology innovation. Crypto investments cover a wide array of assets, from well-known cryptocurrencies to emerging tokens that promise utility in various digital ecosystems.

The volatile nature of cryptocurrencies can lead to significant returns for knowledgeable investors who navigate the market wisely. Crypto assets are recognized for their potential to offer outsized gains due to rapid price movements. Additionally, digital currencies represent a decentralization of financial power, providing a hedge against traditional financial systems and offering a new form of portfolio diversification. The blockchain technology underlying these assets also presents long-term transformative potential across industries.

The Kanna Future Fund exemplifies the dynamic nature of the crypto investment landscape, delivering a remarkable +119.93% return within the year of 2023. This level of performance, with an average growth rate of +10% per month, demonstrates the fund’s successful navigation through the volatile crypto markets, utilizing a combination of sophisticated trading algorithms, expert market analysis, and a diversified portfolio of digital assets. The ability to generate such substantial returns is indicative of a strategy that not only capitalizes on favorable market trends but also mitigates risks associated with the oft-tumultuous crypto sphere. Furthermore, the provision of monthly dividends underscores the fund’s investor-friendly approach, offering a regular income stream in addition to capital gains, which is somewhat unusual in the realm of cryptocurrency investments and reflects a level of stability and confidence in the fund’s performance and management.

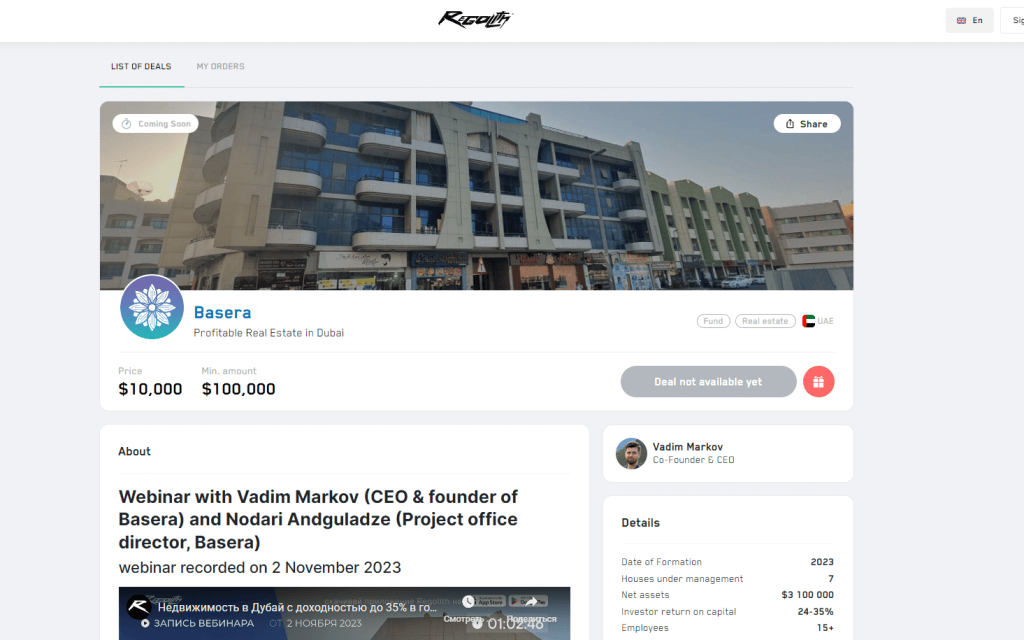

Real Estate Investment Opportunities

Real estate investments with span a comprehensive range of property types, including residential, commercial, and luxury. These investments offer tangible assets that provide stability and the potential for generating passive income through rental yields. The fund focuses on high-return real estate opportunities, leveraging market trends and property development to maximize investor returns.

Real estate stands as one of the most stable investment classes, often providing consistent returns over time through appreciation and rental income. It serves as a robust hedge against inflation, with property values and rental rates typically increasing along with the general price level in an economy. Additionally, real estate investments can offer tax advantages and a source of regular income, making them an attractive option for portfolio diversification and long-term wealth building.

The investment proposition with Basera within the real estate sector is compelling, so far delivering an average annual return of +30%. Even after accounting for fees, investors could still enjoy a robust net return of +21%, which is a testament to the enduring appeal and financial solidity of tangible asset investments. Such performance highlights the strategic acquisition and management of high-potential properties, possibly leveraging market trends like urbanization, demographic shifts, and the appeal of luxury or strategically located real estate. The steady income potential from rentals or the capital gains from property appreciation contributes to this strong return profile. It’s a reflection of prudent asset selection and management, along with a deep understanding of the real estate market dynamics, which are crucial in identifying properties that are likely to yield above-average returns. This underscores real estate’s reputation as a stable investment vehicle, often resistant to the short-term volatility seen in other investment markets, and solidifies its role as a cornerstone in diversified investment portfolios.

Conclusion

As we delve deeper into the capabilities and offerings of , it’s clear that the platform is not just about providing access to a range of investment products; it’s about shaping the future of investing. By integrating cutting-edge technology, ethical investing options, and a user-friendly interface, stands as a beacon for what digital investment platforms can achieve. It offers a holistic approach to investing, where diversity, innovation, and ethical considerations are not just added features but foundational elements of the investment experience.

For investors ready to embark on a journey with , the platform promises not just the tools for wealth creation but a partnership in navigating the complexities of the global investment landscape. With its comprehensive suite of investment options, is poised to redefine what it means to invest in the digital age, making it an essential platform for anyone looking to make their mark in finance.

Read More about Regolith on Crunch Dubai

From Concept to Reality: The Birth of Regolith.com

How to invest money in 2023. Lifehack from founder Regolith.com

Regolith.com or Republic: Unlocking Your Investment Potential. Why Regolith.com Stands Out in a Sea of Choices

Investment Guide: How to Start and Where to Invest Money

Regolith.com Venture Investing: Now Available on the App Store

Aleksei Dolgikh

Fully recommend Regolith as a brilliant partner!