The Digital Transformation Sweeping the MENA Region

Picture this: a region where online shopping is not just a convenience, but a way of life. Where consumers are embracing digital payments with open arms, and businesses are riding the wave of e-commerce growth to new heights. Welcome to the Middle East and North Africa (MENA) region in 2024, where digital commerce is experiencing a tidal wave of growth that shows no signs of slowing down.

‘s 4th annual , “The State of Digital Commerce in MENA 2024: A Tale of Rapid, Sustained Growth,” paints a vivid picture of this transformative landscape. The numbers speak for themselves:

| Key Findings | Growth Rate |

|---|---|

| MENA digital payment volumes since 2020 | 658% |

| Year-on-year growth (2022-2023) | 78% |

| Consumers shopping online at least once a week in Saudi Arabia | 180% |

| Consumers shopping online at least once a week in UAE and Kuwait | 140% |

These jaw-dropping figures demonstrate the accelerated adoption of digital commerce and the deepening consumer preference for online shopping in the region. But what’s driving this surge? Let’s dive in.

The Rise of the Digital-Savvy Consumer

MENA consumers are embracing online shopping like never before. The reveals a staggering 56% increase in the number of consumers engaging in e-commerce weekly or more since 2020. Leading the charge is Saudi Arabia, with an astounding 180% growth in consumers shopping online at least once a week. The UAE and Kuwait are not far behind, each experiencing a 140% growth.

This shift in consumer behavior reflects a growing trust in the digital economy. As more people experience the convenience and variety offered by online shopping, their habits are changing, and e-commerce is becoming an integral part of their lives.

A Bright Future for Online Spending

Despite global economic challenges, MENA consumers remain optimistic about their future online spending. Half of all shoppers anticipate an increase in their online purchases over the next 12 months, with Saudi Arabia leading the way. A whopping 53% of Saudi online shoppers expect to spend more in the coming year.

This positive sentiment is a testament to the resilience and robustness of the digital economy in the region. As consumers become more comfortable with online shopping and digital payments, businesses have a unique opportunity to tap into this growing market.

The Fall of Cash on Delivery

One of the most significant shifts in the MENA e-commerce landscape is the move away from cash on delivery. Over the past 48 months, the preference for this payment method has halved from 41% to 20%. In countries like Saudi Arabia, UAE, and Kuwait, the preference for cash has plummeted to as low as 10%.

This trend presents a golden opportunity for businesses to streamline their operations and reduce costs. By embracing digital payment solutions, companies can offer a more scalable and customer-friendly experience while minimizing the complexities of cash management and logistics.

Payment Security: The Loyalty Game-Changer

In the world of digital commerce, payment security has emerged as the ultimate loyalty driver. A growing number of respondents rank it as the most important feature offered by an e-commerce business. However, the also uncovers some alarming statistics:

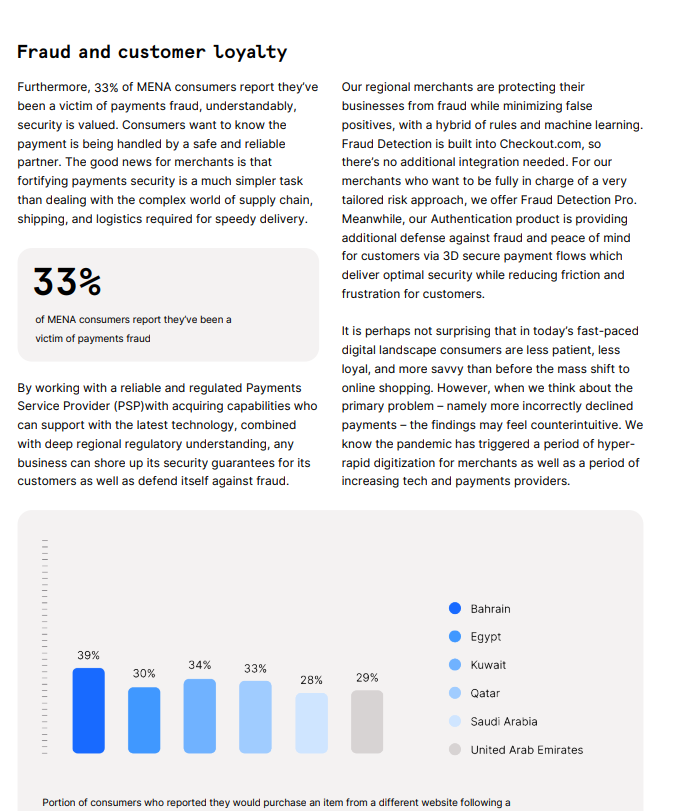

- 33% of MENA consumers have been victims of payment fraud

- 23% have experienced falsely declined payments in the last three months

- 1/3 of shoppers would switch to a competitor after a single failed payment

These findings underscore the critical importance of robust payment security measures. Businesses that prioritize secure, seamless transactions will be well-positioned to win customer trust and loyalty in this rapidly evolving market.

Navigating the Tidal Wave

As the digital commerce landscape in MENA continues to evolve at breakneck speed, businesses must stay agile and adaptable. Remo Giovanni Abbondandolo, General Manager for MENA at , stresses the need for fintechs to continuously analyze and optimize their e-commerce experience to meet the changing needs of digitally-savvy consumers.

Read more on CrunchDubai:

The serves as a valuable roadmap for merchants, policymakers, and stakeholders looking to ride the wave of digital growth in the region. By understanding the key trends, challenges, and opportunities, businesses can position themselves for success in this exciting new era of e-commerce.

So, buckle up and get ready to surf the tidal wave of digital commerce in MENA. The future is here, and it’s just a click away.

Vasilii Zakharov

The article rightly highlights the potential of e-commerce in the region, but it is extremely important to approach this boom with cautious optimism. By solving the problems and understanding the main factors influencing this growth, we can ensure the prosperity of the MENA e-commerce landscape and become a sustainable force for economic progress.