Angel Investing in Dubai Tech Startups: A Comprehensive Guide for Beginners

Dubai has emerged as a thriving hub for technology startups, attracting entrepreneurs and investors from across the globe. As the city’s startup ecosystem continues to flourish, angel investing has become an increasingly popular way for individuals to support innovative ventures and potentially reap significant rewards. This comprehensive guide will walk you through the essentials of angel investing in Dubai’s tech startup scene, providing valuable insights for both novice and experienced investors.

Understanding the Dubai Tech Startup Ecosystem

Dubai’s tech startup landscape has experienced exponential growth in recent years, fueled by government initiatives, a strategic location, and a business-friendly environment. The city’s diverse economy and forward-thinking approach have created fertile ground for startups across various sectors.

Best Technology Startups in Dubai to Watch

Dubai’s tech ecosystem is flourishing, with several startups gaining international recognition for their innovative solutions. Here are some of the most promising technology startups to keep an eye on:

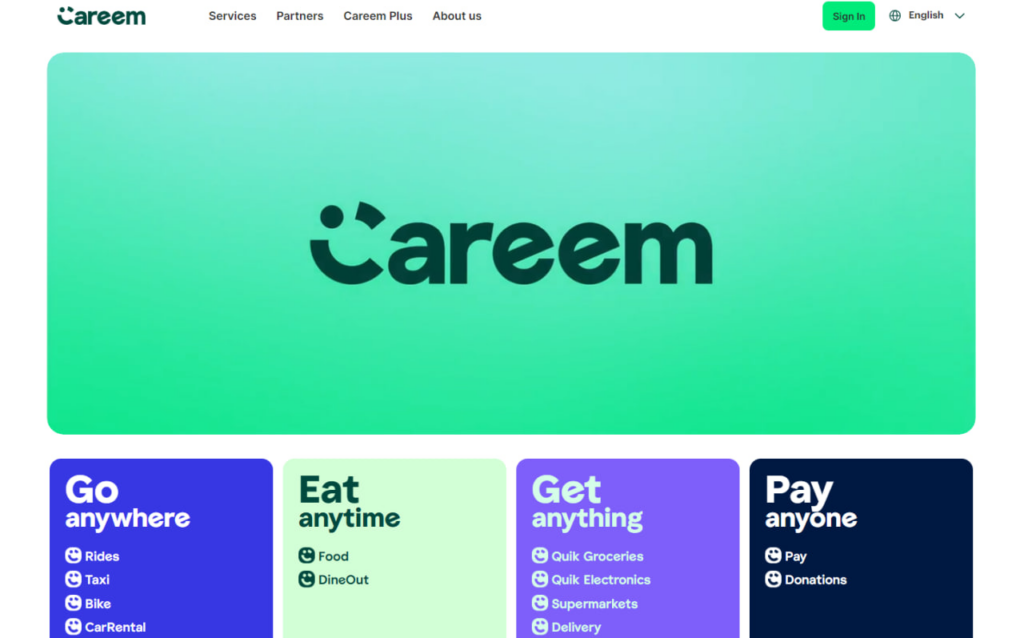

Careem

has become a household name in the Middle East. Founded in Dubai in 2012, it started as a ride-hailing service but has since evolved into a super app offering multiple services. After being acquired by Uber for $3.1 billion in 2020, Careem continues to innovate and expand its offerings.

Key features:

- Ride-hailing services

- Food delivery

- Digital payments (Careem Pay)

- Bike-sharing service in some cities

Kitopi

, short for “Kitchen Utopia,” is revolutionizing the food delivery industry with its cloud kitchen concept. Founded in 2018, this Dubai-based startup has experienced rapid growth and expansion.

Key features:

- Cloud kitchen platform

- Partnership with over 200 brands

- Presence in multiple countries

- Utilizes AI and machine learning for kitchen optimization

Sarwa

is democratizing investing in the Middle East. This fintech startup, founded in 2017, offers a user-friendly platform for both novice and experienced investors.

Key features:

- Robo-advisory services

- Low-cost investment options

- Personalized portfolio management

- Islamic investing options

Swvl

Although originally from Egypt, has a significant presence in Dubai and is making waves in the transportation sector. Founded in 2017, Swvl aims to revolutionize the way people commute in developing markets.

Key features:

- Mass transit solutions

- Ride-sharing services

- Corporate transportation services

- School bus services

Fetchr

is tackling one of the biggest challenges in e-commerce in the Middle East: last-mile delivery. Founded in 2012, this logistics company uses GPS technology to make deliveries in a region where many locations lack a formal address system.

Key features:

- GPS-based delivery system

- E-commerce fulfillment services

- Cross-border shipping

- Cash on delivery options

These startups represent the diverse and innovative tech landscape in Dubai, addressing local and regional challenges while demonstrating potential for global impact. As Dubai continues to invest in its startup ecosystem and attract global talent, we can expect to see more groundbreaking companies emerge, further solidifying the city’s position as a leading tech hub in the MENA region.

Why Angel Investing in Dubai Tech Startups is Booming

The surge in angel investing activity in Dubai can be attributed to several factors:

- A maturing startup ecosystem

- Increased government support for entrepreneurship

- High potential returns on investment

- Diversification opportunities for investors

Opportunities in Financial Technology Startups

Fintech is one of the fastest-growing sectors in Dubai’s tech scene. With the UAE’s push towards a cashless economy, startups focusing on digital payments, blockchain technology, and financial inclusion are attracting substantial investor interest. The city’s strategic location and regulatory framework make it an ideal hub for fintech innovation in the MENA region.

Read more: Top 10 Fintech Startups to Watch in MENA: Revolutionizing Finance in 2024

Healthcare Technology Startups on the Rise

The COVID-19 pandemic has accelerated the adoption of healthcare technology worldwide. In Dubai, startups developing telemedicine solutions, AI-powered diagnostics, and digital health platforms are gaining traction among both users and investors. The government’s focus on creating a world-class healthcare system has further fueled growth in this sector.

Read more: Leading AI-Powered Healthcare Startups and Companies in the MENA Region

Agriculture Technology Startups in Dubai and MENA

As food security becomes increasingly important in the region, agritech startups are emerging with innovative solutions. From vertical farming to smart irrigation systems, these ventures offer exciting opportunities for angel investors looking to make an impact. Dubai’s commitment to sustainability and food security has created a conducive environment for agritech innovation.

How to Invest in Startups: A Guide for Dubai Angel Investors

Angel Investing for Dummies: Getting Started in Dubai

If you’re new to angel investing, start by:

- Educating yourself about the local startup ecosystem

- Networking with experienced investors and entrepreneurs

- Joining angel investing groups or platforms

- Attending pitch events and startup showcases

Building a strong network is crucial in the Dubai startup scene. Attend industry events, join entrepreneurship forums, and participate in startup competitions to gain insights and meet potential investment opportunities.

How to Invest in Startups with Little Money in Dubai

You don’t need to be a millionaire to become an angel investor. Consider these strategies:

- Join angel investing syndicates to pool resources

- Explore equity crowdfunding platforms

- Start with smaller investments to diversify your portfolio

- Look for startups offering convertible notes or SAFE agreements

Remember that even small investments can yield significant returns if you choose the right startups. Focus on quality over quantity and be prepared to provide value beyond just capital.

Angel Investing Platforms and Groups in Dubai

Top Angel Investing Platforms for Dubai Tech Startups

Several online platforms connect angel investors with promising startups in Dubai. These platforms often provide due diligence support, deal flow, and networking opportunities. Some popular platforms include:

- VentureSouq

- Eureeca

- MAGNiTT

- AstroLabs

These platforms can help you streamline your investment process and gain access to curated startup opportunities.

Read more: 9 Best Startups in Dubai to Watch in Summer 2024

Joining Angel Investing Groups in the UAE

Joining an angel investing group can provide valuable support, shared expertise, and deal flow. Look for groups that align with your investment interests and risk tolerance. Some notable angel investing groups in the UAE include:

- Dubai Angel Investors

- WAIN (Women’s Angel Investor Network)

- Falcon Network

These groups often host regular meetings, pitch sessions, and educational events for members.

Strategies for Successful Angel Investing in Dubai Tech Startups

Due Diligence Tips for Investing in Technology Startups

Thorough due diligence is crucial for successful angel investing. Key areas to assess include:

- The founding team’s background and expertise

- Market potential and competitive landscape

- Business model and revenue projections

- Intellectual property and technology stack

- Regulatory compliance and legal structure

Don’t hesitate to seek expert advice or collaborate with other investors during the due diligence process.

How to Invest in Startups for Equity in Dubai

When investing for equity, consider:

- Valuation and terms of the investment

- Equity stake and potential dilution

- Exit strategies and liquidity events

- Shareholder rights and protections

- Vesting schedules and founder commitments

Negotiate terms that align with your investment goals and provide adequate protection for your interests.

Risks and Rewards of Angel Investing in Dubai’s Technology Sector

Angel investing carries inherent risks, but it also offers the potential for significant returns. Understanding both sides of the equation is crucial for making informed investment decisions.

Potential Returns from Investing in New Technology Startups

While success stories of angel investors earning 10x or even 100x returns are enticing, it’s important to maintain realistic expectations. Diversification and patience are key to managing risk and maximizing potential returns. Be prepared for the possibility that some investments may fail, while others might take years to generate returns.

Success Stories: Angel-Backed Tech Startups in Dubai

Highlighting successful exits and growth stories of angel-backed startups in Dubai can provide inspiration and valuable lessons for aspiring investors. Some notable success stories include:

(acquired by Uber for $3.1 billion)

(acquired by Amazon for $580 million)

(raised $415 million in Series C funding)

These examples demonstrate the potential for significant returns in the Dubai tech startup ecosystem.

Blockchain Technology Startups Making Waves

Dubai has positioned itself as a blockchain-friendly city, attracting numerous startups in this space. From supply chain solutions to decentralized finance applications, blockchain startups offer exciting investment opportunities. The Dubai Blockchain Strategy aims to make Dubai the first city fully powered by blockchain by 2020, creating a conducive environment for innovation in this sector.

Resources for Aspiring Angel Investors in Dubai’s Tech Scene

Best Angel Investing Books and Courses

To deepen your knowledge, consider exploring recommended books on angel investing and enrolling in courses tailored to the Dubai and MENA markets. Some popular resources include:

- by David S. Rose

- by Brad Feld and Jason Mendelson

- Angel Investment Network’s online courses

- Dubai Entrepreneurship Academy’s workshops and seminars

Angel Investing Blogs and Online Resources

Stay informed about the latest trends and opportunities by following reputable angel investing blogs and online resources focused on the Dubai tech ecosystem. Some valuable sources include:

- Dubai Chamber of Commerce and Industry’s entrepreneurship resources

Legal Considerations for Angel Investing in Dubai Tech Startups

Understanding Abu Dhabi Angel Investing Regulations

Familiarize yourself with the legal framework for angel investing in the UAE, including regulations set by the Abu Dhabi Global Market (ADGM) and the Dubai International Financial Centre (DIFC). Key areas to understand include:

- Company registration requirements

- Investment structures and vehicles

- Shareholder agreements and rights

- Exit regulations and repatriation of funds

Consider consulting with a legal expert specializing in UAE startup law to ensure compliance and protect your investments.

In conclusion, angel investing in Dubai tech startups offers exciting opportunities for investors looking to support innovation and potentially achieve significant returns. By understanding the local ecosystem, conducting thorough due diligence, and leveraging available resources, you can position yourself for success in this dynamic market. Remember that angel investing carries risks, and it’s essential to approach it with a balanced portfolio and a long-term perspective. As Dubai continues to establish itself as a global tech hub, the potential for rewarding angel investments in the region’s startups has never been greater.