, a household name in the UAE’s fresh food retail industry, has unveiled its plans to embark on a new chapter in its storied history by launching an initial public offering (IPO) and listing its ordinary shares on the Dubai Financial Market (DFM). The Spinneys IPO presents an exciting opportunity for investors to be a part of the company’s future growth and success, as it celebrates its centennial anniversary in the region and sets its sights on expanding into the lucrative Saudi Arabian market.

Spinneys IPO: Key Highlights

The Spinneys IPO will comprise 900,000,000 shares, equivalent to 25% of the company’s total issued share capital. The subscription period is set to commence on Tuesday, April 23, 2024, and will conclude on Monday, April 29, 2024, for UAE retail investors, while professional investors will have until Tuesday, April 30, 2024, to subscribe. The company expects its shares to be admitted to trading on the DFM in May 2024.

Spinneys has also outlined its dividend policy, which aims to reward shareholders with consistent returns. Starting from the fiscal year 2024, the company plans to distribute dividends twice a year, in April and October, with a target pay-out ratio of 70% of annual distributable profits.

Spinneys IPO: Building on a Legacy of Success

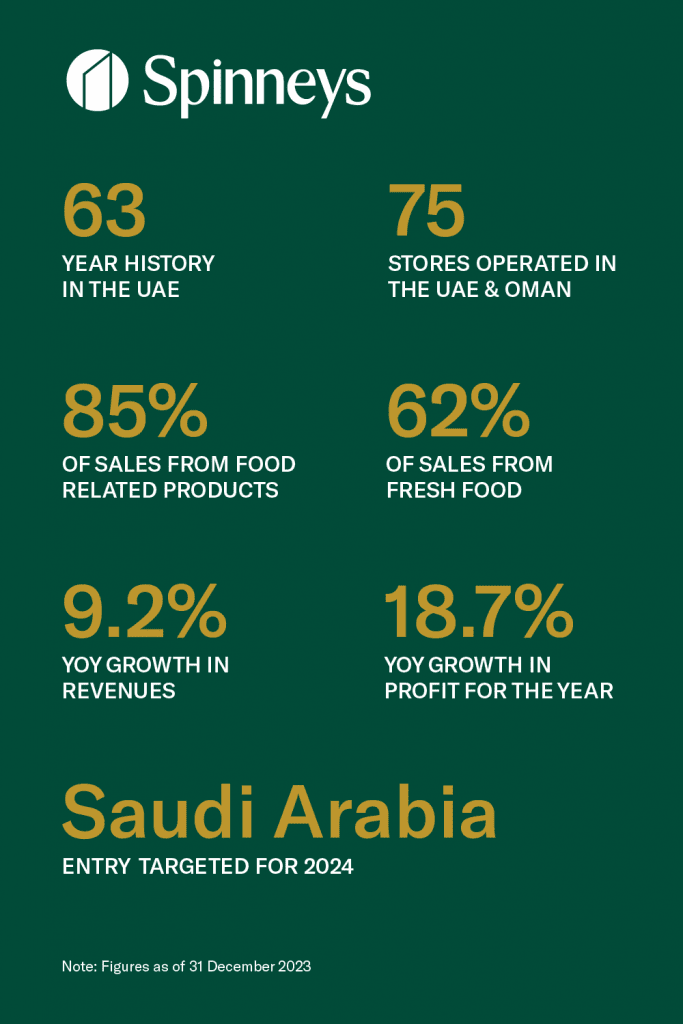

Spinneys’ decision to go public through the IPO is underpinned by its strong market position, robust financial performance, and promising growth prospects. As one of the leading fresh-focused food retailers in the UAE, the company has built a reputation for quality, convenience, and exceptional customer service. Spinneys operates in a sizeable market characterized by growing, resilient long-term demand for premium fresh food products.

The company’s growth strategy is not limited to its home market. Spinneys is well-positioned for regional expansion, particularly in Saudi Arabia, the GCC’s largest economy. The company has set its sights on opening four stores in the Kingdom in 2024, marking a significant milestone in its international growth journey.

Spinneys IPO: A Recipe for Long-Term Growth

Several factors contribute to Spinneys’ long-term growth potential, making the Spinneys IPO an attractive opportunity for investors. The UAE’s affluent population is expected to grow at a faster pace than the overall population, driving sustained demand for premium fresh food products. Additionally, Spinneys’ extensive fresh food range, which accounts for more than 50% of its SKUs in 2023, sets it apart from competitors. The company’s exclusive private labels and strategic partnerships with leading international brands further strengthen its value proposition.

Spinneys’ success is also attributed to its exceptional local execution capabilities, supported by a well-invested, vertically integrated global sourcing network and two centralized production facilities in the UAE. The company’s experienced and focused team, with 22% of the workforce having been with the group for 10 years or more, is another key asset.

Spinneys IPO: Solid Financials and Future-Proofing Strategies

In 2023, Spinneys achieved impressive financial results, with revenue growing to AED2.87 billion at a CAGR of 8.2% from 2019. This growth was driven by increasing online penetration, private label penetration, strategic pricing, and an expanding store footprint in the UAE. The company’s gross profit margin reached 42% in 2023, while profit for the year stood at AED254 million, marking an 18.7% increase from 2022.

Looking ahead, Spinneys is implementing a multi-faceted growth strategy that includes like-for-like growth, expansion in the UAE and Saudi Arabia, the launch of “The Kitchen, by Spinneys” concept, and operational efficiencies. The company is also investing in future-proofing its operations by commissioning a new production facility in 2027 at the Dubai Food Tech Valley and increasing its private label participation and self-sufficiency.

Spinneys IPO: A Sustainable Future Led by Experienced Leaders

Spinneys is guided by a well-tenured, experienced leadership team with an ownership mindset and a focus on sustainability. The company’s commitment to environmental, social, and governance (ESG) principles is evident in its various initiatives, such as the ‘Spinneys Farmers’ Club,’ which supports local growers in adopting sustainable farming practices, and the ‘Local Business Incubator’ program, which nurtures UAE-based entrepreneurs and enhances local production.

Read more on CrunchDubai:

Spinneys IPO: Timeline and Key Information

- Intention to float announcement: 16 April 2024

- Opening of subscription: 23 April 2024

- Retail subscription closure: 29 April 2024

- Final price offer announcement: 1 May 2024

- Refunds: 7 May 2024

- Expected listing date: 9 May 2024

- Market: DFM

- Website:

As Spinneys embarks on this transformative journey, the Spinneys IPO offers investors a unique opportunity to be a part of its growth story. With a strong heritage, a commitment to quality, and a proven track record of success, Spinneys is well-positioned to capitalize on the growing demand for premium fresh food products in the UAE and the broader GCC region. The company’s strategic initiatives, experienced leadership, and focus on sustainability make the Spinneys IPO an attractive prospect for investors seeking exposure to the region’s thriving food retail sector.

Vasilii Zakharov

The launch of Spinneys IPO marks a significant moment in the Dubai food landscape, ushering in a new era of convenience and choice for consumers.With its innovative approach and commitment to quality, Spinneys opens not just a store, but also a new chapter in the culinary journey of the city. Exciting times are ahead for Dubai’s foodies, as the Spinneys IPO promises to redefine the shopping experience and set new standards in the industry.