Introduction:

Navigating the can feel like traversing a labyrinth, especially with the myriad of options available with 21 THOUSANDS plus of insurance reviews (!) and 150,000 plus policyholders in personal and business insurance. Whether you’re in the bustling city of Dubai or elsewhere in the UAE, finding the right insurance policy that offers both protection and value can be daunting.

Sponsors in International SEO the

This guide will illuminate the path, offering insights and tips on how to secure the best insurance deals, leverage insurance comparison tools, and tap into the expertise of insurance advisors to meet your specific needs. From car insurance to health insurance, and from home insurance to more niche areas like pet insurance and yacht insurance, we’ve got you covered. Let’s embark on this journey to demystify the insurance buying process, ensuring you make informed decisions that safeguard your assets and well-being.

InsuranceMarket.ae Founder & CEO Avinash Babur ACII

The Essence of Insurance Comparison

In the whirlwind pace of today’s life, choosing the right insurance policy directly from a provider like Insurance Market is more crucial than ever. This company stands out by offering a diverse range of insurance types, tailored to meet the varied needs of individuals and businesses alike. Insurance Market simplifies the decision-making process by providing direct access to a variety of insurance options. Whether you’re in the hunt for extensive Dubai insurance or UAE insurance plans, selecting your policy through Insurance Market can be a game-changer.

Opting for policies from Insurance Market means you’re not just buying insurance; you’re choosing a partner that understands the importance of financial protection insurance, alongside ensuring you and your loved ones have access to quality healthcare and emergency medical assistance whenever necessary. From car insurance to health insurance, and home insurance to life insurance, all the way through to specialized covers like pet insurance, bike insurance, and yacht insurance—Insurance Market has got it all covered.

Diving into their offerings allows you to find insurance solutions that are not only competitive in terms of pricing but also robust in terms of the protection they offer. This approach not only aids in securing deals that shield you financially but also guarantees that you’re well-supported in times of need, be it through comprehensive health care options or crucial assistance during travel mishaps.

Personalizing Your Protection with Personal Insurance

Personal insurance is all about securing your peace of mind. From health insurance policies that provide preventive care benefits and maternity insurance benefits, to life insurance that offers financial security for your loved ones, personalizing your insurance coverage ensures that you’re protected against life’s uncertainties. And let’s not forget about pet insurance coverage and bike insurance – because every aspect of your life deserves protection.

Securing Your Business with the Right Business Insurance

For entrepreneurs and business owners in the UAE, acts as a safety net that can mean the difference between recovery and ruin following unexpected events. Customizable insurance policies offer protection against third-party liability, property damage, and even insurance for chronic conditions that might affect your employees. Insurance advisors play a pivotal role here, offering insights into insurance partners and claims process that cater specifically to business needs.

Navigating Through Dubai Insurance and UAE Insurance Landscape

The Dubai insurance market, much like the broader UAE insurance landscape, is diverse and dynamic. It offers a range of products from car insurance to home insurance quotes, and travel insurance online. For expatriates, finding insurance for expatriates in UAE that covers medical emergencies coverage and comprehensive health insurance is crucial. The myAlfred platform stands out as a beacon for those looking to simplify their search for the perfect insurance solution in the UAE, providing a seamless insurance comparison Dubai experience.

Embracing the Future with Insurance Claims Management and Digital Platforms

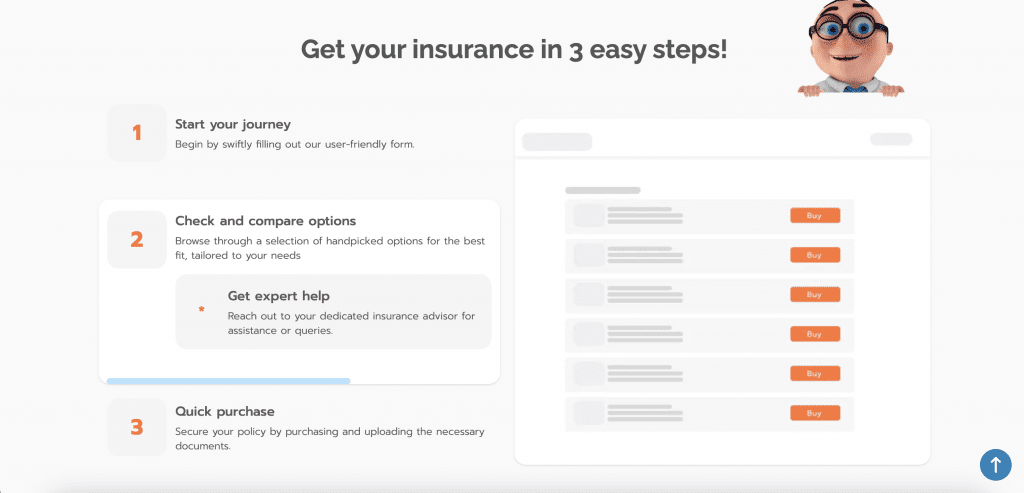

In the age of digital transformation, insurance claims management has evolved. Platforms like myAlfred not only facilitate easy comparison and purchase of policies but also streamline the claims process, making it less cumbersome for policyholders. This shift towards digital is enhancing customer experiences, offering enhanced benefits plans (EBP), comprehensive coverage options, and customizable insurance policies at the tip of your fingers.

Conclusion: The Road Ahead in Insurance

Navigating the insurance market requires a keen understanding of your needs, coupled with the insights on how to meet those needs efficiently. Whether it’s securing insurance coverage for your latest adventure or ensuring your business is protected against unforeseen losses, the key lies in making informed decisions. Leverage insurance comparison tools, seek advice from reputable insurance advisors, and stay abreast of the latest insurance deals to not just insure, but ensure a safer future for yourself and your loved ones.

Embarking on your insurance journey? Remember, the right coverage is out there, and with the right approach, you’ll find it. Stay informed, stay protected, and let the peace of mind that comes with having the right insurance propel you forward in life and business.

InsuranceMarket.ae Office Dubai

FAQs:

Q: How important is it to compare insurance before buying? A: Comparing insurance is crucial as it helps you understand the range of options available, ensuring you get the best coverage at the most competitive rates.

Q: Can digital platforms like myAlfred really make a difference in finding insurance? A: Absolutely. Digital platforms simplify the comparison process, offer a wide range of options, and facilitate easy management of your insurance policies.

Q: What should I look for in a good insurance advisor? A: Look for experience, knowledge of the insurance market, transparency, and a track record of helping clients find optimal insurance solutions.

Navigating the insurance market might seem like a daunting task, but with the right information and tools at your disposal, it becomes an empowering journey towards securing your future. Remember, the goal isn’t just to buy insurance but to buy the right insurance for your unique needs.