In today’s fast-paced world, securing your future and that of your loved ones has never been more crucial. With the myriad of insurance options available, it can be overwhelming to find one that truly meets your needs and offers peace of mind. Enter , a beacon of reliability and innovation in the insurance industry. This article delves into why stands out and how its official app and government site for payment make the process seamless and user-friendly.

Iloe Insurance Review: Navigating the Landscape of Financial Security

has emerged as a notable entity in the insurance sector, recognized for its reliability, technological innovation, and customer-centric approach. Distinguishing itself from traditional insurance providers, positions itself as a partner in its clients’ journey toward financial security and peace of mind, rather than merely a service provider. The company offers a diverse portfolio of products, including comprehensive health policies with extensive coverage options and life insurance plans designed to ensure the financial well-being of families.

One of the key factors that set apart is its commitment to leveraging technology to enhance its service delivery. This commitment is evident in the company’s efforts to make insurance more accessible and understandable to the general public. By simplifying the insurance process and adopting a personalized approach, ensures that its policies are tailored to meet the specific needs and circumstances of each policyholder.

Furthermore, places a strong emphasis on client education, empowering policyholders with the knowledge and resources needed to make informed decisions about their insurance coverage. Through various tools and educational materials, clients are able to understand the details of their policies, the benefits they are entitled to, and how to maximize the value of their insurance. This educational initiative by aims to demystify insurance, making it more approachable and less intimidating for individuals seeking financial protection.

In summary, stands out in the insurance industry for its innovative use of technology, personalized service, and focus on client education. These attributes contribute to its growing reputation as a reliable and forward-thinking insurance provider, dedicated to meeting the diverse needs of its clientele and ensuring their financial security.

Understanding Iloe Insurance Terms and Conditions

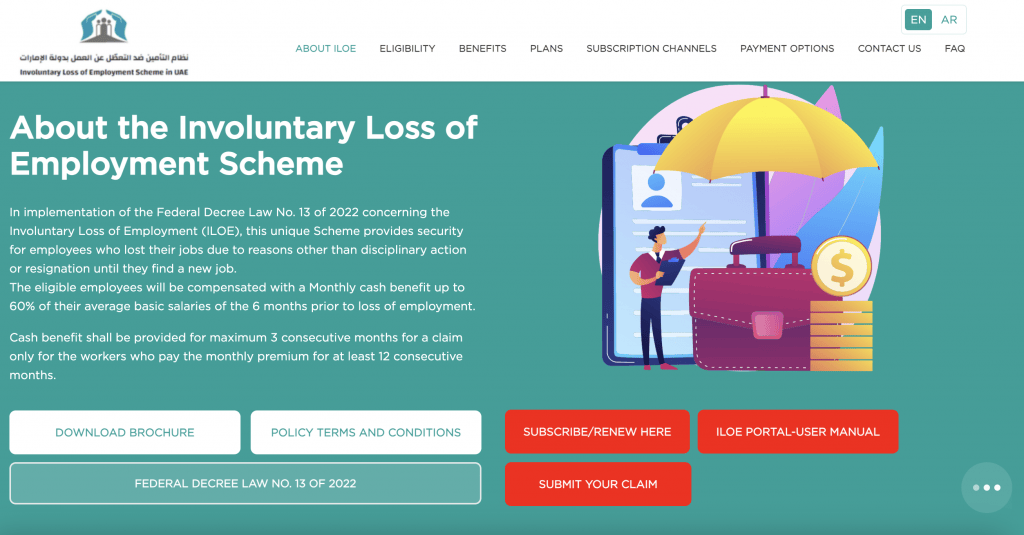

The scheme, as detailed on their official website, is a pioneering initiative designed to provide security for employees in the UAE who lose their jobs due to reasons other than disciplinary action or resignation. Here’s a closer look at the terms and conditions, eligibility, and compensation benefits of the scheme:

Eligibility for Iloe Insurance

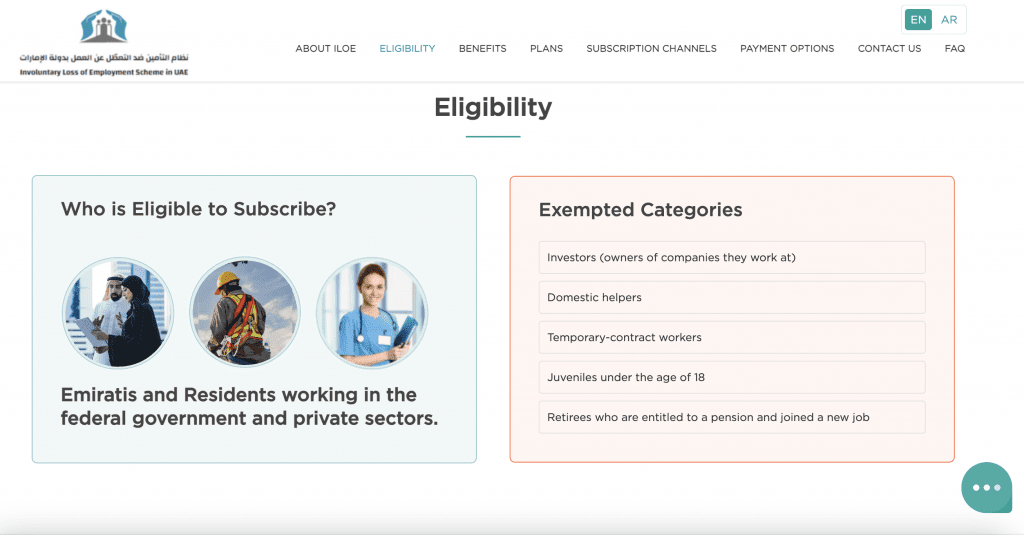

Who Can Subscribe? The scheme is open to Emiratis and residents working in both the federal government and private sectors. This wide eligibility criterion ensures that a significant portion of the workforce in the UAE has access to this protective measure.

Exempted Categories: However, not everyone is eligible. The scheme specifically excludes investors (owners of the companies they work at), domestic helpers, temporary-contract workers, juveniles under the age of 18, and retirees who are entitled to a pension and have joined a new job.

Compensation Benefits

- Monthly Compensation: Eligible employees can receive up to 60% of their average basic salary of the 6 months prior to their involuntary loss of employment. This compensation is designed to provide a financial cushion, helping individuals navigate the period of unemployment with less financial stress.

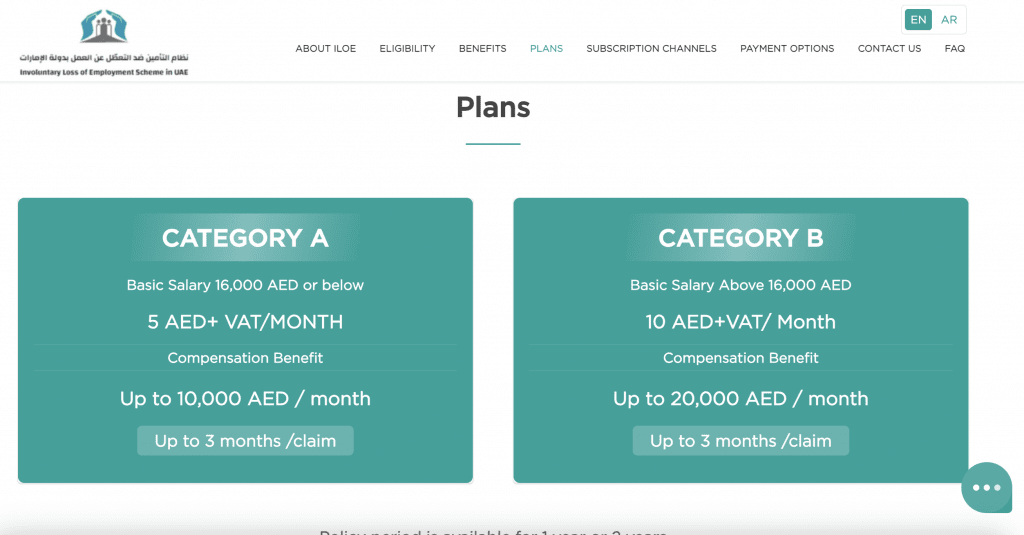

- Maximum Claim Benefits: The scheme differentiates between two categories of employees based on their basic salary:

- Category A: For those with a basic salary of 16,000 AED or below, the maximum claim benefit is 10,000 AED per month.

- Category B: For those with a basic salary above 16,000 AED, the maximum claim amount is 20,000 AED per month.

- Duration of Benefits: Compensation is available for up to 3 consecutive months for any one claim. Over the entire working life of the insured in the UAE, the total claim payment cannot exceed 12 monthly benefits, regardless of the number of claims submitted.

The Official Iloe Insurance App: Your Insurance, On the Go

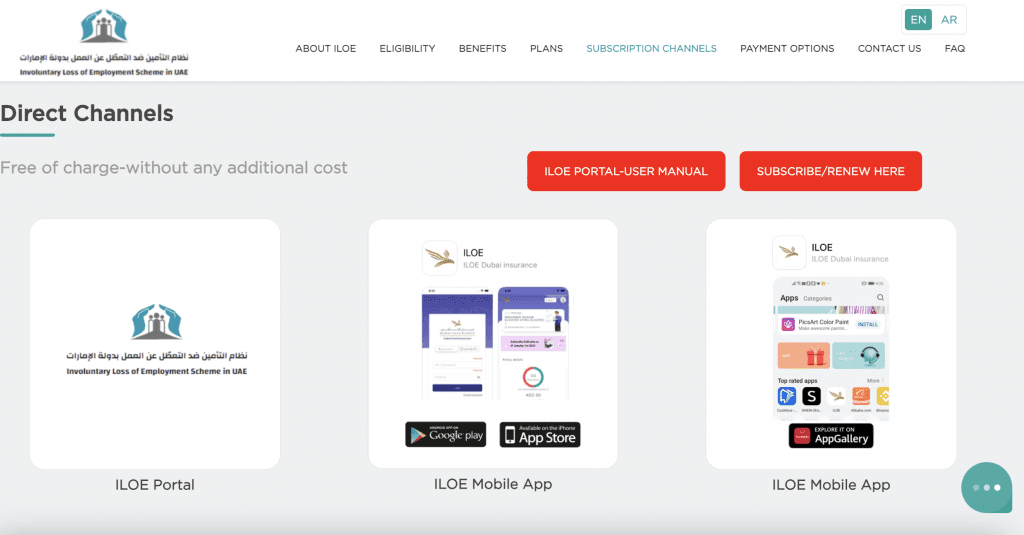

In an era where convenience is king, Iloe Insurance has stepped up its game by launching its official app, available on both and . This app is not just another addition to your digital toolkit; it’s a gateway to managing your insurance needs efficiently and effortlessly.

Features That Set It Apart

- Ease of Access: With the Iloe Insurance app, your insurance details are at your fingertips. Whether you need to review your policy, update personal information, or check your coverage, it’s all possible with a few taps on your screen.

- Instant Updates: Stay informed with real-time notifications about your policy and any relevant updates from Iloe Insurance.

- Hassle-Free Payments: The app integrates seamlessly with the official government site for payment, making it easier than ever to keep your policy active without any hiccups.

Simplifying Payments: The Official Government Site

Understanding the importance of simplicity and security in transactions, Iloe Insurance has partnered with the government to offer a straightforward payment solution through the official site . This initiative underscores Iloe Insurance‘s commitment to providing a user-friendly experience, ensuring that making payments is as simple as a few clicks.

Why This Matters

- Security: Leveraging the government’s secure platform guarantees that your payment information is protected.

- Convenience: Eliminate the need for physical visits or lengthy phone calls. Your payments can now be completed online, saving you time and hassle.

- Transparency: With instant confirmation and digital receipts, you’ll always have a clear record of your transactions.

Conclusion: Iloe Insurance Is Leading the Way

In the evolving landscape of the insurance industry, Iloe Insurance stands out for its approach to integrating technology and simplifying the payment process. The company has introduced an app and a direct link to the official government payment site, aiming to enhance user experience in terms of convenience, security, and reliability. This move by Iloe Insurance reflects a broader trend towards digital transformation within the sector.

Observers note that Iloe Insurance’s efforts to streamline insurance processes and make them more accessible could significantly impact how consumers interact with insurance services. The company’s initiatives are particularly noteworthy for their potential to appeal to a wide range of demographics, from young professionals to families looking for reliable insurance coverage.

Read More on CrunchDubai:

As the insurance industry grapples with the challenge of adapting to digital-first consumers, Iloe Insurance’s recent innovations could serve as a model for others in the field. The company’s focus on user-friendly technology and efficient payment methods is a clear indication of its commitment to simplifying the insurance experience for its customers.