has become a popular choice among savvy consumers looking to maximize their financial potential. With its array of rewards, cashback offers, and travel benefits, it’s no wonder why so many are opting for this versatile credit card. This comprehensive guide will walk you through everything you need to know about the FAB Credit Card, from its benefits to the application process and beyond.

Overview of FAB Credit Card

FAB Credit Card Benefits

The FAB Credit Card offers a plethora of benefits tailored to meet diverse financial needs. These include:

- Reward Points: Earn points on every purchase and redeem them for a variety of options.

- Cashback Offers: Enjoy cashback on dining, groceries, and online shopping.

- Travel Perks: Access to airport lounges, travel insurance, and discounts on flight bookings.

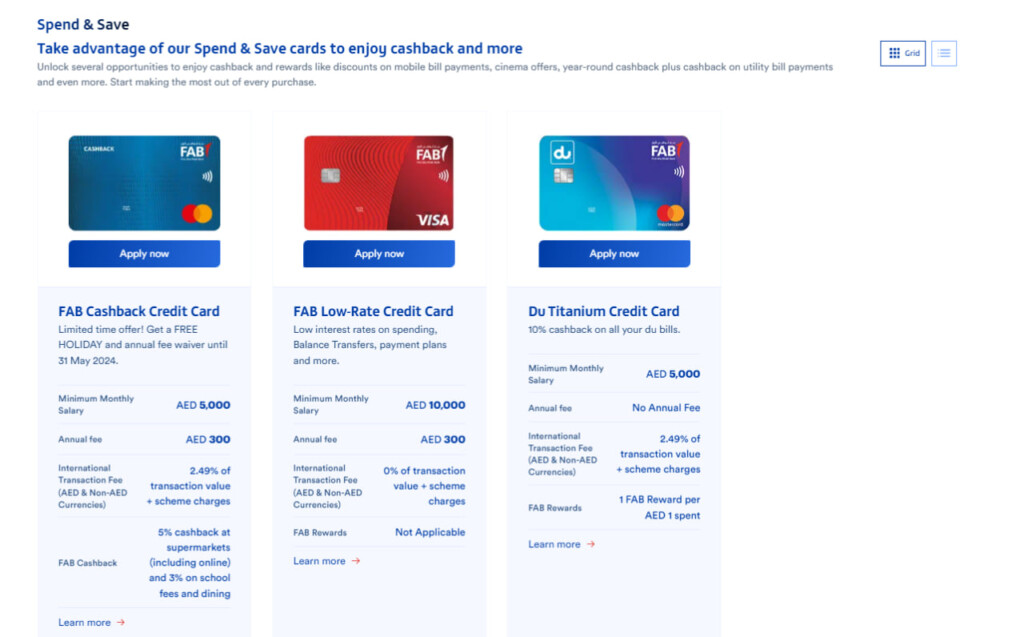

Best FAB Credit Card for Your Needs

Choosing the right FAB Credit Card depends on your spending habits and financial goals. Here’s a brief comparison:

| Card Type | Ideal For | Key Benefits |

|---|---|---|

| Frequent travelers | Travel insurance, airport lounge access | |

| Everyday expenses | High cashback rates on groceries and fuel | |

| Maximize reward points | Bonus points on all purchases |

Applying for FAB Credit Card

How to Apply for FAB Credit Card

Applying for a FAB Credit Card is a straightforward process:

- Visit the : Navigate to the FAB credit card application page.

- Choose Your Card: Select the card that best suits your needs.

- Fill in the Application Form: Provide the required personal and financial details.

- Submit Documents: Upload necessary documents such as ID proof, income proof, etc.

- Review and Submit: Double-check the information and submit your application.

FAB Credit Card Eligibility Requirements

Before applying, ensure you meet the eligibility criteria:

- Age: Minimum 21 years old.

- Income: Stable and verifiable income.

- Credit Score: A good credit history is essential.

- Residency: Must be a resident of the UAE.

Tips for a Successful FAB Credit Card Application

- Maintain a Good Credit Score: Regularly check your credit score and resolve any issues.

- Provide Accurate Information: Ensure all details in your application are accurate and up-to-date.

- Submit Complete Documentation: Incomplete applications may result in delays or rejections.

FAB Credit Card Features

FAB Credit Card Rewards Program

The rewards program is one of the standout features of the FAB Credit Card. Key highlights include:

- Points on Every Purchase: Earn points for every dirham spent.

- Easy Redemption: Redeem points for travel, shopping, dining, and more.

- Bonus Points: Earn extra points during promotional periods.

FAB Credit Card Cashback Offers

Cashback offers provide significant savings:

- Dining: Up to 10% cashback at selected restaurants.

- Groceries: Earn cashback on your everyday grocery shopping.

- Online Shopping: Additional cashback on purchases from partner e-commerce sites.

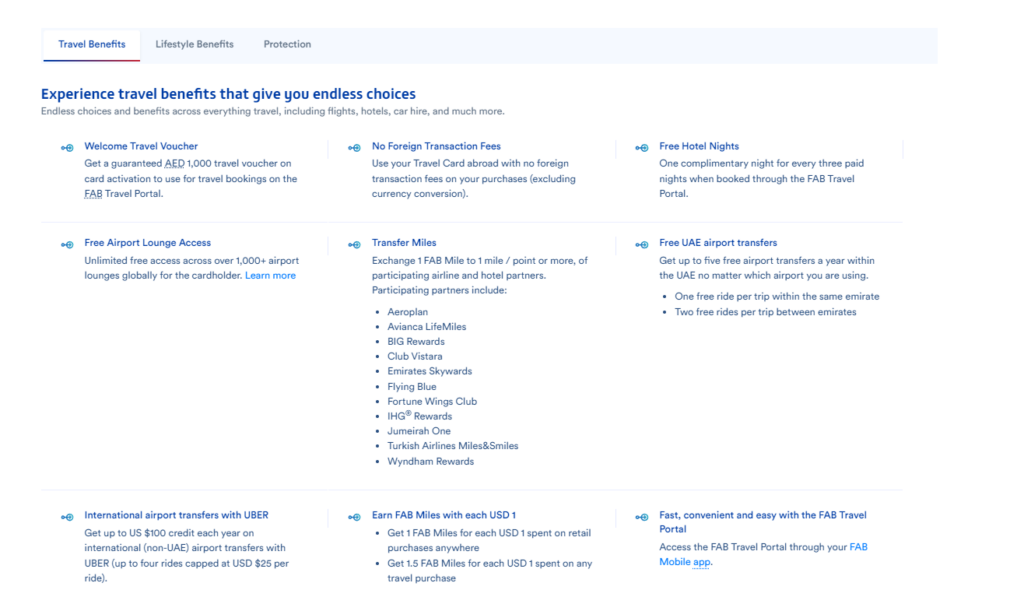

FAB Credit Card Travel Benefits

Travel enthusiasts can enjoy numerous perks:

- Airport Lounge Access: Complimentary access to lounges worldwide.

- Travel Insurance: Coverage for trip cancellations, medical emergencies, and more.

- Discounted Flights: Exclusive discounts on flight bookings with partner airlines.

Managing Your FAB Credit Card

FAB Credit Card Payment Methods

Managing payments is easy with multiple options:

- Online Banking: Pay your bills via FAB’s online banking portal.

- Mobile App: Use the FAB mobile app for quick payments.

- Auto Debit: Set up automatic debits from your FAB bank account.

Read more: FAB Mobile App: The Ultimate Tool for Managing Your Finances on the Go

How to Increase Your FAB Credit Card Limit

Increasing your credit limit can provide more financial flexibility. Follow these steps:

- Check Eligibility: Ensure your account is in good standing.

- Request Through Online Banking: Log in to your FAB account and request a limit increase.

- Contact Customer Service: Speak with a representative to discuss your needs.

- Submit Income Proof: Provide additional income proof if required.

Understanding FAB Credit Card Fees

Being aware of fees helps in managing expenses:

- Annual Fees: Varies by card type.

- Interest Rates: Typically based on outstanding balances.

- Late Payment Fees: Charges for delayed payments.

- Foreign Transaction Fees: Applicable on international purchases.

FAB Head Office Information

Location and Contact Details

The FAB Head Office is a key point of contact for cardholders:

- Address: Khalifa Business Park – Zone 1 – Abu Dhabi

- Contact Number: 600 52 5500

Services Offered at the Head Office

The head office provides comprehensive services:

- Account Management: Assistance with account queries and issues.

- Card Services: Support for card activation, deactivation, and replacements.

- Financial Advisory: Expert advice on managing finances and investments.

Importance of the Head Office for Credit Card Holders

The head office plays a crucial role in:

- Customer Support: Dedicated team to handle complex queries.

- Service Efficiency: Streamlined processes for quicker resolutions.

- Centralized Management: Ensuring consistent service standards.

How to Get Assistance from the Head Office

For assistance, you can:

- Call Customer Care: For immediate help and support.

- Visit the Office: For in-person consultations.

- Email: For non-urgent inquiries.

Read more about FAB: FAB Private Banking: Elevating Wealth Management to New Heights

Customer Experience

FAB Credit Card Customer Service Review

Customer service is pivotal in maintaining satisfaction. Key points include:

- 24/7 Support: Round-the-clock assistance.

- Multilingual Staff: Support available in multiple languages.

- Efficient Resolution: Prompt handling of queries and complaints.

Common Complaints and How to Address Them

Understanding common issues can help in addressing them effectively:

- Delayed Transactions: Ensure timely bill payments and monitor statements.

- High Fees: Regularly review fee structures and opt for plans that best suit your usage.

- Card Declines: Keep your card within credit limits and inform the bank of travel plans.

Comparison and Alternatives

FAB Credit Card vs. Other Leading Cards

When comparing FAB Credit Cards to others, consider:

| Feature | FAB Credit Card | Competitor A | Competitor B |

|---|---|---|---|

| Rewards | Extensive rewards program | Limited rewards | No rewards program |

| Cashback | High cashback rates | Moderate cashback | Low cashback |

| Travel Benefits | Complimentary lounge access | Paid lounge access | No travel benefits |

Pros and Cons of FAB Credit Card

Every card has its strengths and weaknesses:

Pros:

- High cashback rates

- Extensive travel benefits

- Robust rewards program

Cons:

- Annual fees may be high for premium cards

- Stringent eligibility criteria

Conclusion

The FAB Credit Card stands out for its comprehensive benefits, including robust rewards, significant cashback offers, and valuable travel perks. Whether you’re a frequent traveler or looking for everyday savings, there’s a FAB Credit Card that fits your needs. Apply today and unlock the financial freedom and convenience that comes with being a FAB cardholder.

Read more on CrunchDubai:

FAQs

How to apply for a FAB Credit Card? Visit the FAB website, choose your card, fill in the application form, and submit the required documents.

What are the benefits of the FAB Credit Card? Benefits include reward points, cashback offers, travel perks, and more.

What are the eligibility requirements for a FAB Credit Card? You must be at least 21 years old, have a stable income, a good credit score, and be a resident of the UAE.

How can I increase my FAB Credit Card limit? Request a limit increase via online banking, customer service, or by providing additional income proof.

What are the common fees associated with FAB Credit Cards? Fees may include annual fees, interest rates on balances, late payment fees, and foreign transaction fees.

How do I contact FAB customer service? You can reach FAB customer service via their contact number, email, or by visiting the head office.

Vasilii Zakharov

This is a great review of Fab Credit Card! I am glad to learn more about its exclusive rewards and benefits. The article promises comprehensive guidance, so I’m looking forward to finding out if this card is right for me.