Fintech Startup Poised to Transform Supply Chain Financing

In a groundbreaking move set to reshape the B2B payments landscape, UAE-based fintech startup has secured a $5 million debt facility from a prominent Abu Dhabi-based private family office. This strategic investment is poised to accelerate Comfi’s ambitious plans in the Buy Now, Pay Later (BNPL) sector, specifically tailored for business-to-business transactions.

A Game-Changer for B2B Supply Chain Financing

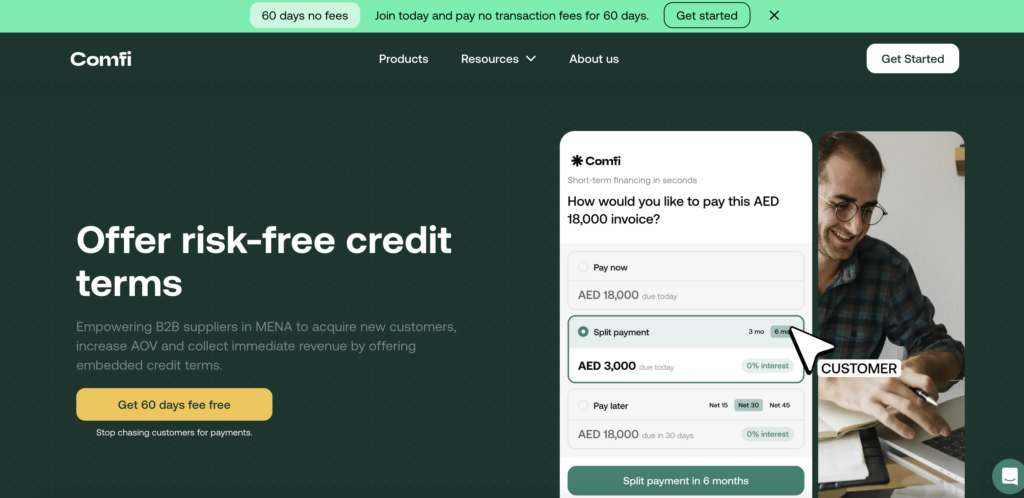

innovative platform is not just another payment solution – it’s a lifeline for businesses struggling with cash flow. By offering flexible payment terms of up to 90 days, Comfi is addressing a critical pain point in the B2B ecosystem. This move could potentially unlock millions in working capital for businesses across the UAE and Saudi Arabia.

Key Highlights of Comfi’s $5 Million Funding

- Founder-driven innovation: Established in 2023 by visionaries Alisher Akbarov, Amal Abdullaev, and Sanjar Samiev

- Embedded solutions: Rollout of cutting-edge pay-later and pay-now options for B2B supply chains

- Massive market impact: Projected to facilitate $40 million in B2B transactions within a year

- Regional focus: Targeting rapid expansion in UAE and KSA markets

Empowering Manufacturers and Suppliers

platform stands out by empowering manufacturers and suppliers with flexible payment solutions while ensuring they receive upfront payments. This dual benefit creates a win-win situation for all parties involved in the supply chain.

The Future of B2B Payments: Comfi’s Vision

Sanjar Samiev, CEO of , shared his excitement about the company’s trajectory:

“This substantial funding, backed by a reputable Emirati family office, will catalyze Comfi’s ability to onboard more B2B companies. We’re not just supporting their growth; we’re fueling their success across industries. Our commitment to leveraging advanced technology and strategic partnerships will drive innovation and foster financial inclusion throughout the UAE and KSA.”

Why Comfi’s Approach Matters

- Real-time credit decisions: Enabling instant 90-day credit terms for B2B customers

- Financial inclusion: Opening doors for businesses previously underserved by traditional banking

- Supply chain efficiency: Streamlining payments to improve overall business operations

- Tech-driven solutions: Utilizing cutting-edge technology to address complex B2B payment challenges

Read more on CrunchDubai:

The Road Ahead: Comfi’s Impact on Regional Economics

As gears up to facilitate an estimated $40 million worth of B2B transactions, the ripple effects on the UAE and KSA economies could be substantial. By injecting liquidity into the supply chain and easing cash flow pressures, Comfi is positioning itself as a key player in driving economic growth and business expansion in the region.

The future of B2B payments in the Middle East is evolving, and Comfi is at the forefront of this transformation. With its innovative approach and strong financial backing, the company is well-positioned to redefine how businesses transact, grow, and thrive in an increasingly digital economy.