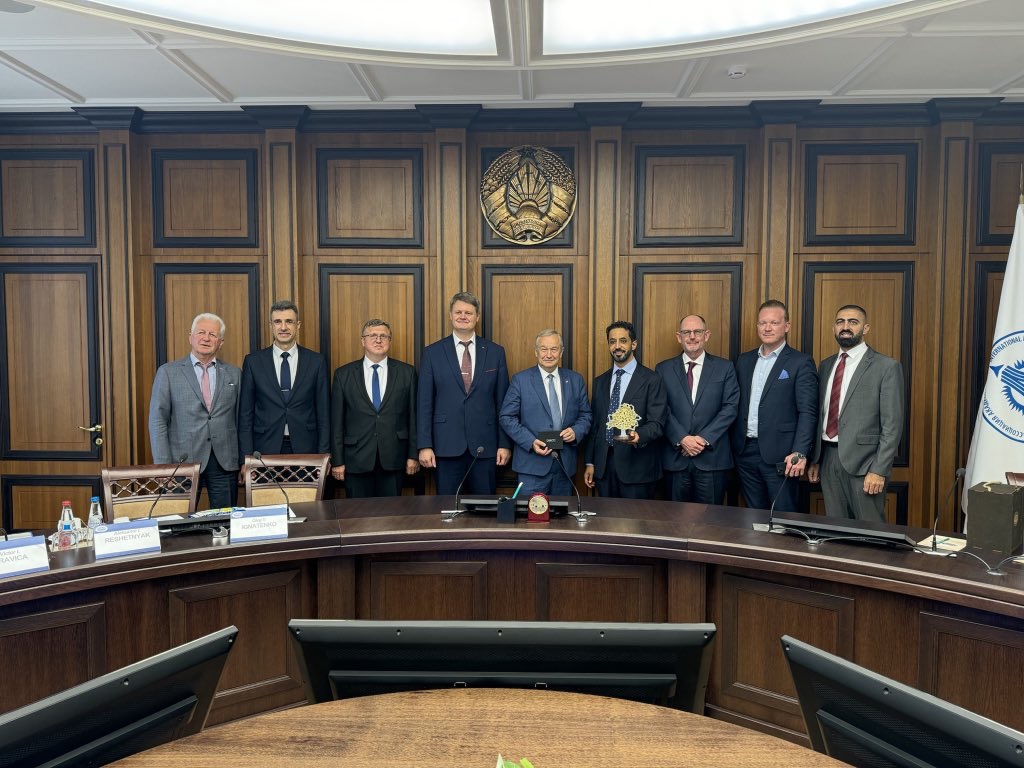

As the sun rises over the bustling streets of Minsk, a historic meeting unfolds between two powerhouses in global trade. Ahmed Bin Sulayem, the visionary Executive Chairman and CEO of the Dubai Multi Commodities Centre (DMCC), steps onto Belarusian soil, welcomed by Kiyoko Dmitry, First Deputy Minister, and Ivan Stepanenko, Head of the Main Department of Precious Metals and Precious Stones. This is no ordinary diplomatic visit; it marks a crucial chapter in the story of global commodity trading.

DMCC, a titan in the world of gold and diamond trading, has long been the bedrock of Dubai’s economy, driving billions in trade annually. Now, with Belarus emerging as a significant player in the diamond industry, this meeting symbolizes the forging of a new alliance—one that promises to reshape the landscape of global commodities. Together, these leaders are not just discussing trade; they are laying the groundwork for a future where Dubai and Minsk stand side by side as pillars of ethical, prosperous trade.

This visit is more than a diplomatic gesture; it’s a strategic move that highlights the growing importance of Belarus in the global diamond trade and DMCC’s commitment to expanding its influence across Europe and beyond.

HTP aka High Tech Park Belarus

Once upon a time in the chilly yet innovative heart of Eastern Europe, there was a place where tech dreams were coded into reality—Belarus’s very own Hi-Tech Park (HTP). Now, if you imagine a startup fairyland, you’d be right, except this fairyland came with a robust internet connection, tax breaks, and a community of brilliant minds who might just be part robot—because how else do you explain their productivity?

Let’s talk about Arkadiy Dobkin, the wizard behind EPAM Systems. You see, Arkadiy didn’t just ride the tech wave; he practically invented the surfboard. Starting from HTP, EPAM grew into a global powerhouse, and by 2024, they were pulling in nearly $4.6 billion a year. Sure, they’ve scaled operations outside Belarus, but it’s safe to say that without HTP, EPAM’s code might’ve crashed before it ever compiled.

Then there’s Dmitry Gurski, Yuri Gurski, and Dmitry Yudovsky—the trifecta of tech geniuses who brought you Flo Health. Picture this: they took the chaos of women’s health and streamlined it into an app that’s now valued at over $1 billion. How? They started small in HTP, where they debugged the complexities of healthcare, turning them into simple user experiences. The result? Millions of women worldwide now trust an app that began its journey in this Belarusian tech haven.

Of course, no story about HTP would be complete without Victor Kislyi, the mastermind behind Wargaming and the legendary World of Tanks. Victor didn’t just create a game; he launched a global battlefield where millions of players fight it out in pixelated glory. With $7 billion in revenue and over 350 million registered users by 2024, Wargaming proves that sometimes, the pen (or in this case, the code) really is mightier than the sword.

And let’s not forget Ivan Sukharevsky from SayGames. This guy has turned mobile gaming into an art form, with his games consistently ranking high in download charts globally. Starting from HTP, Ivan cracked the code on what makes a game not just good, but irresistibly addictive. It’s safe to say, SayGames is playing in the big leagues now, all thanks to its roots in the fertile soil of HTP.

But HTP isn’t just about the giants; it’s also a breeding ground for startups with the potential to go global. Think VibroBox, with its prescriptive diagnostics for machinery that could probably predict when your fridge will go on strike. Or OneSoil, which uses AI to help farmers get more from their land—because why not make agriculture as smart as your phone?

So, if you ever find yourself in Minsk, know that you’re walking on ground where innovation is practically the national sport, and the players are some of the brightest minds the tech world has ever seen. HTP isn’t just a tech park; it’s where code comes to life, startups grow up, and global success stories begin their journey.

Now, that’s what I call turning “Hello, World!” into “Hello, Universe!”

Dubai DMCC & Belarus Ministry of Agriculture and Ministry Of Finance. Why? Because of the diamonds, gold and commodities in general.

In the world of global trade, where diamonds sparkle and gold glitters, an unexpected yet exciting partnership is forming. On one side, we have Dubai’s DMCC, led by the ever-visionary Ahmed Bin Sulayem. On the other side, Belarus steps into the spotlight, bringing in its heavyweights from the Ministry of Agriculture and Ministry of Finance. But why are these two players joining forces? The answer is simple: they’re both chasing after the same treasures—diamonds, gold, and commodities in general. Let’s dive into this golden (and diamond-studded) story, shall we?

The Gold Standard: Ahmed Bin Sulayem and DMCC’s Global Reach

Ahmed Bin Sulayem, the Executive Chairman and CEO of DMCC, is a man with a golden touch—quite literally. Under his leadership, DMCC has turned Dubai into one of the world’s most influential hubs for commodity trading. With a diverse portfolio that includes everything from gold to diamonds and even crypto, DMCC is the place where the world comes to trade.

In 2024, DMCC reported its second-best year ever, welcoming 2,692 new companies into its fold. This brought the total number of companies registered in the free zone to over 24,000. Talk about a packed house! With over 11% of Dubai’s GDP tied to its activities, DMCC is not just a trading hub; it’s the beating heart of Dubai’s economy.

And when it comes to gold and diamonds, DMCC doesn’t mess around. The Dubai Gold & Commodities Exchange (DGCX), a DMCC subsidiary, trades more gold than you could fit in Fort Knox. Meanwhile, the Dubai Diamond Exchange (DDE) is the world’s largest diamond tender facility, handling billions of dollars worth of diamonds each year. In fact, in 2023 alone, the value of polished diamonds traded in Dubai reached a sparkling $16.9 billion.

Belarus: The Rising Star in Commodities

Now, let’s talk about Belarus, a country that’s been quietly building its reputation in the commodities market. The Belarusian Universal Commodity Exchange (BUCE) is the largest spot commodity exchange in Eastern Europe, with an annual turnover of around $4 billion. That’s a lot of timber, metals, and agricultural goods passing through its doors.

Leading the charge from Belarus are financial wizards like Kiyoko Dmitry, the First Deputy Minister of Finance, and Ivan Stepanenko, Head of the Main Department of Precious Metals and Precious Stones. These folks aren’t just sitting on their hands—they’re making deals, forging partnerships, and looking for new markets to conquer.

And what’s Belarus bringing to the table? Plenty. The country is a significant player in commodities like metals and timber, with exports reaching around $265 million annually to key markets like Kazakhstan. But they’re not stopping there. Belarus is also looking to expand its trade in agricultural products, a sector that’s seeing growing demand globally, especially in the UAE.

Diamonds, Gold, and a Little Bit of Fun

Here’s where the story gets really interesting. Picture this: Ahmed Bin Sulayem, known for his love of high-stakes trading, sitting down with Belarusian officials. They’re not just talking numbers—they’re talking sparkle and shine. Imagine Ahmed joking, “So, how many carats are we talking about?” while sipping his coffee. And let’s not forget the gold—literally. With gold prices dancing around $1,900 to $2,000 per ounce, every conversation about trading this precious metal carries a weight that’s as heavy as, well, gold.

Belarus, for its part, is looking at diamonds in a whole new way. With the global diamond market expected to grow steadily, thanks to increasing demand from luxury sectors, Belarusian leaders like Ivan Stepanenko are eyeing opportunities to polish up their own diamond trade. Who knows, maybe Belarus will soon be known for more than just vodka and tractors!

Connecting the Dots of DMCC, Europe, Africa, Middle East and Asia — and the Markets

Geographically, this partnership is pure genius. Dubai’s DMCC sits at the crossroads of Europe, Asia, and Africa, making it the perfect hub for distributing Belarusian commodities worldwide. And let’s not forget the Middle Eastern market, where demand for high-quality food products—one of Belarus’s strong suits—is on the rise.

But it’s not just about geography; it’s about strategy. By tapping into DMCC’s global networks, Belarus can expand its export markets significantly, especially in Asia, where there’s a growing appetite for metals and agricultural products. Meanwhile, DMCC gains access to Belarus’s rich resources, ensuring a steady supply of the commodities that make Dubai’s markets tick.

A Bright and Shiny Future

This partnership between DMCC and Belarus’s Ministry of Agriculture and Ministry of Finance is more than just a business deal; it’s a match made in commodity heaven.

With leaders like Ahmed Bin Sulayem and Kiyoko Dmitry steering the ship, the future of gold, diamonds, and commodities trading looks brighter than ever—literally.

As they say in the trading world, the only thing better than a diamond in the rough is a diamond that’s been cut, polished, and ready for market. And with these two powerhouses working together, there’s no telling how far they’ll go. So, here’s to a future filled with glittering success and golden opportunities—may the trading be ever in their favor!

Dream Big, Sell Big: How Crunch Media Holdings Can X10 Your ROI in Commodity Trading

Imagine this: You’re at a high-stakes trading conference in Dubai, the air buzzing with excitement and potential deals. The sun is setting over the glittering cityscape, and Ahmed Bin Sulayem, the visionary behind DMCC, casually leans over and asks, “So, how can we make the next big move in global commodities trading?” You flash a smile because you know the answer: Q&A marketing, powered by Crunch Media Holdings, is about to take your sales from good to extraordinary—X10 ROI extraordinary.

The Secret Sauce: Q&A Marketing with a Crunch

When it comes to selling high-value commodities like gold, diamonds, or oil, traditional digital platforms like Google, Facebook, X (formerly Twitter), Pinterest, and TikTok might get you clicks, but let’s be honest—clicks alone don’t pay the bills. You need precision, engagement, and a strategy that goes beyond surface-level interactions. Enter Crunch Media Holdings, where platforms like CrunchDubai.com, CrunchRiyadh.com, and CrunchLatAm.com aren’t just reaching potential buyers—they’re engaging them in meaningful conversations that turn into sales faster than you can say “ROI.”

How Does Q&A Marketing Drive X10 ROI?

1. Engagement Through the Roof

- CPC (Cost Per Click): $2.50 – $5.00

- CPM (Cost Per Thousand Impressions): $25 – $60

- EPC (Earnings Per Click): $10 – $20

- Conversion Rate: 5% – 8%

On platforms like CrunchDubai.com, you’re not just getting clicks—you’re getting conversations. Imagine Kiyoko Dmitry from Belarus’s Ministry of Finance dropping a question about the latest gold prices on CrunchMoscow.com. By the time you’ve answered with a mix of humor and expertise, she’s already considering a deal. This kind of engagement pushes your conversion rate up to 8%, well above the industry average of 2-3%.

2. Trust Equals Transactions

- CPA (Cost Per Acquisition): $200 – $500

- ROAS (Return on Ad Spend): 7:1 – 10:1

In commodity trading, trust isn’t just nice to have—it’s everything. By answering questions and providing valuable insights through Q&A, you’re not just building trust; you’re building long-term relationships. So when Ivan Stepanenko, Head of the Main Department of Precious Metals and Precious Stones in Belarus, asks about diamond valuations, your well-timed, informative response could turn a casual inquiry into a lucrative deal. The result? A staggering ROAS of up to 10:1. Compare that to what you’re getting from Google or Facebook—on a good day, maybe 3:1.

3. Account-Based Marketing (ABM) for Precision Targeting

- ABM Investment: $5,000 – $50,000 per campaign

- ROI on ABM: 10:1 – 15:1

Account-Based Marketing (ABM) is a game-changer for high-value commodity trades. Let’s say Vyacheslav Sass from the Ministry of Energy is on the hunt for new energy investments. By focusing on key accounts with tailored messaging and offers, ABM allows you to drive deeper engagement with fewer but more valuable clients. This strategy often results in a 10:1 to 15:1 ROI, especially when integrated with the personalized content and direct engagement opportunities that platforms like CrunchRiyadh.com provide.

4. Online Reputation Management (ORM)

- Investment in ORM: $2,000 – $10,000 per month

- ROI on ORM: 8:1 – 12:1

- Impact on LTV (Customer Lifetime Value): Increase of 20% – 50%

In today’s digital world, your online reputation is everything. Negative reviews or lack of visibility can cost you dearly in the commodities market, where trust and reputation are paramount. Investing in Online Reputation Management (ORM) can protect and enhance your brand image, leading to higher customer retention and a potential 50% increase in LTV. Platforms like CrunchLatAm.com offer comprehensive ORM services that can deliver an ROI of 8:1 to 12:1 by ensuring your brand is positively represented across all digital channels.

A Global Strategy with Local Impact: Programmatic Advertising on Steroids

But wait, there’s more! Crunch Media Holdings doesn’t just stop at Q&A marketing and ABM. We’ve supercharged our approach with programmatic advertising across ~20 platforms, ensuring that your content reaches the right audience at the right time, whether they’re in China, Germany, France, America, or even Africa.

And let’s talk about language for a second. We’re not just talking English—oh no, we’ve got you covered in Chinese, German, French, Arabic, Hindi, Punjabi, and 14 more languages. Imagine Ahmed Bin Sulayem launching a campaign in multiple languages simultaneously—because why limit your reach when you can go global? SEO on a large scale is our game, and it’s available to you and search engines alike, ensuring your content is not just seen, but understood and acted upon worldwide.

Crunching the Numbers: The Financial Impact

Now, let’s break down the financial impact of leveraging Crunch Media Holdings for your digital marketing:

- CPM (Cost Per Thousand Impressions): With rates between $25 – $60, you’re getting premium exposure in front of a targeted audience that’s ready to engage and convert.

- CPC (Cost Per Click): Costing between $2.50 – $5.00, each click is a potential conversation starter, leading to higher conversion rates of 5% – 8%.

- CPA (Cost Per Acquisition): With acquisition costs ranging from $200 – $500, you’re investing in quality leads that are more likely to convert into long-term clients.

- EPC (Earnings Per Click): Earning $10 – $20 per click, you’re seeing immediate returns that feed directly into your bottom line.

- ABM ROI: Account-Based Marketing campaigns with Crunch Media Holdings yield a ROI of 10:1 – 15:1, ensuring that your high-value clients are fully engaged and ready to do business.

- ORM ROI: Investing in Online Reputation Management delivers an ROI of 8:1 – 12:1, with the added benefit of increasing your Customer Lifetime Value (LTV) by 20% – 50%.

These numbers don’t just promise better results—they guarantee them. When you choose Crunch Media Holdings, you’re choosing a strategy that’s built to deliver measurable, impactful results, all while reducing your reliance on broad, less-targeted platforms like Google or Facebook.

Why Crunch Media Holdings Beats Google, Facebook, and Others

When you invest in digital marketing with Crunch Media Holdings, you’re not just buying ad space—you’re buying a strategy that’s as finely tuned as a Swiss watch. Platforms like Google, Facebook, and TikTok are great for general awareness, but they lack the depth of engagement and trust-building that Crunch platforms offer. Here’s how we do it:

- Precision Targeting: Whether you’re selling diamonds from Africa or oil from the Middle East, Crunch platforms allow you to target the exact audience that’s looking for what you offer.

- High Engagement Rates: With platforms like CrunchDubai.com, you’re getting CTRs (Click-Through Rates) of 3-5%, far above the industry norm. This means more engaged visitors and, ultimately, more sales.

- Superior ROI: With a potential ROAS of 10:1, your investment in Crunch Media Holdings pays off in spades. This isn’t just marketing—it’s a high-yield investment in your business’s future.

What’s the Cost of Not Investing?

Let’s be real—sticking with the status quo can cost you. If you’re relying solely on broad platforms like Google or Facebook, you’re likely missing out on higher engagement, better conversion rates, and, most importantly, higher profits. Every dollar not spent with Crunch Media Holdings is a missed opportunity to maximize your ROI.

The Crunch Media Package: Your Ticket to Global Commodity Success

The Dubai Media Package from Crunch Media Holdings is designed to give you the tools and reach you need to dominate global commodity markets. Here’s what you get:

- Targeted Q&A Sessions: Engage directly with buyers from China, America, Europe, and Africa.

- Custom Content Creation: We create tailored content that resonates with your target market, boosting your SEO and engagement metrics.

- Comprehensive Analytics: Track every click, impression, and conversion with detailed reports that show exactly how your investment is paying off.

Ready to X10 Your ROI?

Imagine closing deals worth millions, reaching new markets, and becoming a trusted name in commodity trading—all while enjoying a cup of coffee in Dubai, knowing that your digital marketing strategy is not just working, but thriving. That’s the power of Q&A marketing, Account-Based Marketing, Online Reputation Management, and programmatic advertising with Crunch Media Holdings.

So, the next time you’re faced with the choice of where to spend your marketing dollars, remember this: You can invest in generic platforms and hope for the best, or you can partner with Crunch Media Holdings and watch your sales—and your ROI—soar. The choice is yours.

Visit CrunchDubai.com **to learn more about how we can help you achieve X10 ROI and take your commodity

Your chance to share your opinion and argue in the comments