Independent Summary of WIO Personal 2024: WIO Bank offers a revolutionary banking experience that allows you to save, spend, borrow, manage, and invest your money all in one place. With WIO Bank, you can earn up to 4% interest on uninvested cash in your ?? AED or ?? USD Saving Spaces. Enjoy the convenience of free multi-currency accounts and spend in your preferred currency without worrying about foreign exchange fees.

Start investing with as little as USD$1 with WIO Personal

Start investing with as little as USD$1 and access thousands of stocks, ETFs, and fractional shares. Experience ultra-fast and secure international money transfers to over 100 countries at attractive exchange rates. Simplified credit options are also available with low interest rates and smart reminders. Earn rewards on all your spends and choose to receive cashback in ?? AED or auto-invest in stocks. Join the WIO Personal Beta Program to be a part of the banking revolution.

Open an account digitally within minutes using the WIO Personal app.

Save more and achieve your goals with up to 4% interest on AED or 2% interest on USD. Invest safely in a wide range of options, including stocks, fractional shares, ETFs, and IPOs. Say goodbye to boring banking with WIO Bank and regain control of your finances. WIO Bank is regulated by the Central Bank of the UAE.

The official link:

WIO Personal In Media

WIO Personal LinkedIn

WIO Facebook

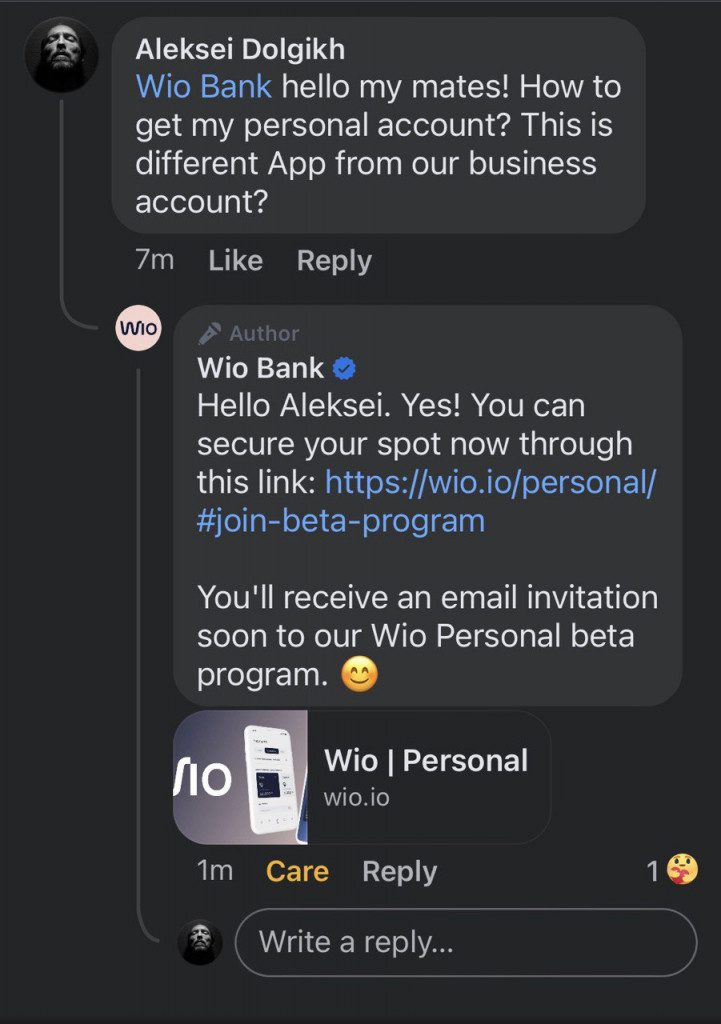

CVO MyGlocal FZ-LLC Aleksei Dolgikh Asked WIO Bank Common Questions Of WIO Business Bank Account Owner

Hello! The Wait Is Over! Introducing Wio Personal, the bank that will win your heart. ![]()

Here’s a sneak peak of what’s awaiting you:

1. 6% p.a. interest on savings over AED 35K.

2. Commission-free trading: start with just US$1.

3. 1% cashback on AED card spends

4. Send money globally to over 100 countries—best rates, no hidden fees

5. Transparent and straightforward fees.

How to get my personal WIO Bank Account?

- Start by visiting the .

- Navigate to the “” section.

- Click on “Open bank account in UAE online” aka:

- OR

- .

- Fill in the required details and submit the necessary documents, which usually include a copy of your Emirates ID / Passport, UAE visa, and proof of address.

- Once your application is approved, you will have access to your personal WIO bank account.

How WIO Personal Different From WIO Business Account?

- The “WIO Personal” account is designed for individual use. It offers features like online banking, debit cards, and the ability to make international transfers. It is ideal for expats looking for a “bank account for foreigners in UAE”.

- On the other hand, the “WIO Business” account is designed for businesses operating in the UAE. It offers additional features like payroll services, business loans, and merchant services.

- While both accounts offer the convenience of “UAE bank account non-resident” services, the “WIO Business” account provides more comprehensive solutions for businesses.

- It’s important to note that the “best bank in UAE for expats” would depend on the specific needs and circumstances of the individual or business.

What documents are required to open a personal bank account in the UAE?

To open a personal bank account in the UAE, expatriates are typically required to provide the following documents:

- Valid Passport with Residence Visa: A copy of your passport showing your residence visa in the UAE.

- Proof of Residence: This could include utility bills or rental agreements, showing your address in the UAE.

- Employment Verification: Documents that verify your employment status in the UAE, such as a job letter or employment contract.

- Completed Application Form: The application form provided by the bank for opening an account.

- Emirates ID: A copy of your Emirates ID card, which is a mandatory identification card for residents of the UAE.

- Salary Certificate or NOC: A salary certificate or a no-objection certificate (NOC) from your employer or sponsor in the UAE.

- Initial Deposit: A certain amount of money is required as an initial deposit to open the account, typically ranging between 3,000 and 5,000 AED (820 to 1,360 USD).

- Additional Documents for Non-Residents: If you’re a non-resident, you might also need to provide a copy of your passport with the UAE entry page, an original reference letter from your bank in your country of origin or another country, and an updated CV.

These requirements can vary slightly between different banks, so it’s recommended to check with the specific bank you’re interested in for their exact requirements.

Are there any minimum balance requirements for opening a personal bank account in the UAE?

What types of personal bank accounts are available in the UAE, and what are their key features?

How long does it typically take to open a personal bank account in the UAE?

Are there any fees associated with opening a personal bank account in the UAE?

Can non-residents of the UAE open a personal bank account?

What are the options for accessing and managing funds in a personal bank account in the UAE?

Are personal bank accounts in the UAE protected by deposit insurance?

What are the currency options for personal bank accounts in the UAE?

WIO Bank provides free accounts in multiple currencies, including AED, USD, EUR, and GBP. This feature is highly beneficial for those who engage in global transactions as it allows for spending in local currencies and saves on foreign exchange fees.

Are there any specific regulations or restrictions on personal bank accounts for expatriates in the UAE?

In the UAE, there are specific regulations and requirements for expatriates looking to open personal bank accounts. Here’s a breakdown of what you need to know:

- Minimum Salary Requirement: To open a salary account, expatriates generally need a minimum salary ranging from AED 3,000 to AED 10,000, although this can vary depending on the bank.

- Required Documents: Expatriates must provide several key documents, including a valid passport with a residence visa, proof of residence, employment verification, and a completed application form. These are essential for opening a bank account in Dubai.

- Initial Deposit: Banks in the UAE typically require an initial deposit to open an account. The amount can range from 3,000 to 5,000 AED (approximately 820 to 1,360 USD).

- Additional Documentation for Non-Residents: For non-residents, additional documentation is required. This includes a copy of the passport with the UAE entry page, an original copy of a reference letter from your bank in your country of origin or another country, and an updated CV.

- Mandatory Use of IBAN: In the UAE, the use of the International Bank Account Number (IBAN) is mandatory for all transactions and wire transfers to and from the country. Additional required documents include a copy of the passport, UAE visa, Emirates ID, and a salary certificate or a no-objection letter from the sponsor.

It’s important to note that these requirements may vary slightly depending on the bank and specific account types. Therefore, it’s advisable for expatriates to directly contact the banks they are interested in for the most up-to-date information and specific requirements.

Aleksei Dolgikh

As the Chief Visionary Officer of and a user of the , I must say that the WIO Personal account is an exceptional banking solution. It provides a seamless experience for managing and growing your personal finances. With features like high-interest rates on savings, multi-currency accounts, and easy access to global investments, WIO Bank truly empowers individuals to take control of their money. The user-friendly interface and innovative features make it a standout choice in the market. I highly recommend WIO Personal Account to anyone looking for a modern and efficient banking experience.

Olga Nayda

I already have WIO’s personal bank account 👏👏👏. Love it, but cards are not available yet, so I’m only plan to invest in shares with that