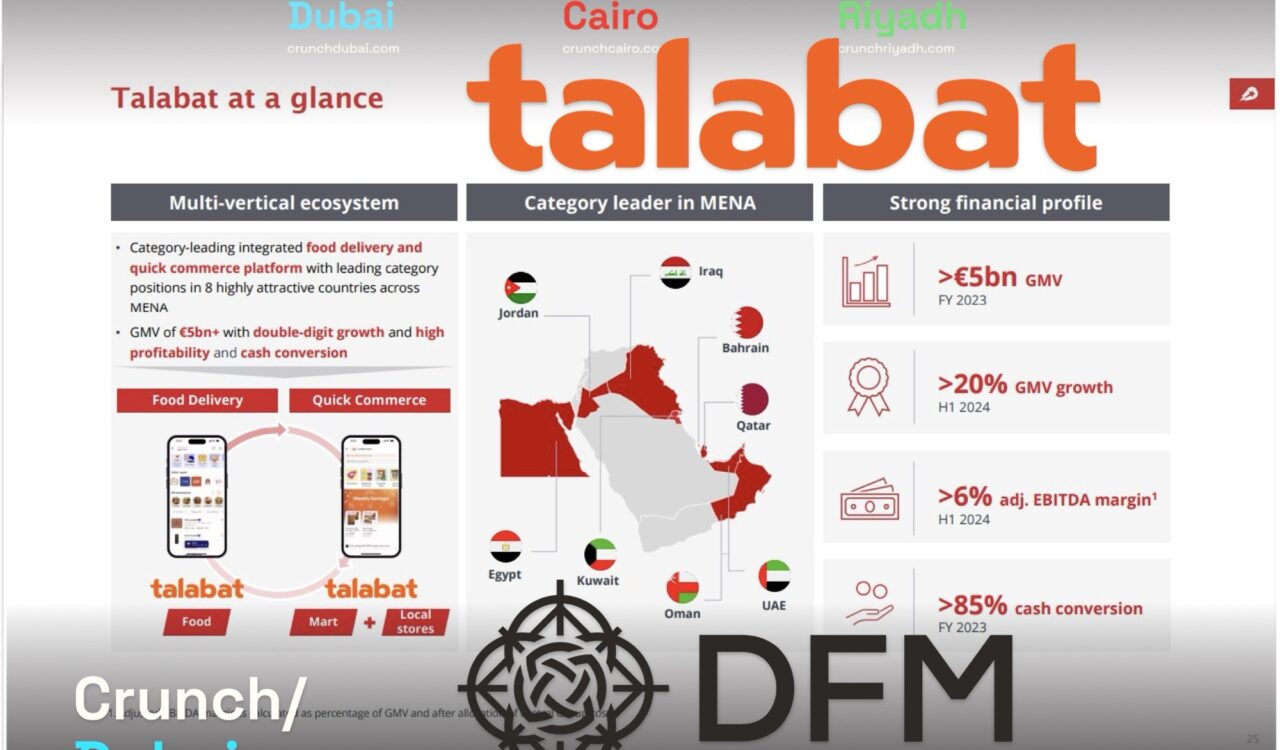

Talabat’s upcoming IPO on the Dubai Financial Market, driven, acquired, started and lead by Abdulaziz Al Loughani, Khaled Al Otaibi, Niklas Östberg, Emmanuel Thomassin, Johannes Bruder, Oliver Samwer, Marc Samwer, and Alexander Samwer, is expected to be one of the most significant financial events in the MENA region in 2024. This listing, potentially raising billions, will cement Talabat’s position as a regional powerhouse, following its parent company, Delivery Hero’s MENA operations, which contributed EUR 874.7 million (28.9%) to its Q2 2024 revenue and EUR 3.2 billion (26.6%) in GMV. With a Gross Merchandise Value (GMV) surpassing $5 billion in FY2023 and a robust 6% adjusted EBITDA margin in 1H2024, Talabat is set to outperform recent UAE IPOs, including Spinneys (AED 1.38 billion), Parkin (AED 1.6 billion), and Dubai Taxi (AED 1.2 billion).

The leadership at Dubai Financial Market, including Hamed Ali, Essa Kazim, and Maryam Fekri, is pivotal in navigating this substantial listing. Their efforts will support Talabat’s expansion, particularly as MENA has become the second-largest revenue contributor for Delivery Hero, following Asia, with impressive growth fueled by surging consumer demand and strong market traction in Turkey.

Who is acquired Talabat?

* Talabat was acquired by Rocket Internet, led by Oliver Samwer, Marc Samwer, and Alexander Samwer, for $170 million in 2015, strategically expanding their influence in MENA’s food delivery sector. In 2016, Niklas Östberg, CEO of Delivery Hero, along with Talabat’s leadership team, including Abdulaziz Al Loughani and Khaled Al Otaibi, saw Talabat absorbed into Delivery Hero’s portfolio, further solidifying their global market leadership.

Dubai Financial Market Talabat IPO

Delivery Hero SE (“Delivery Hero” or the “Company”, ISIN DE000A2E4K43, Frankfurt Stock Exchange: DHER), which operates in the United Arab Emirates (“UAE”) and other countries in the Middle East and North Africa its food delivery and quick commerce business under the Talabat brand, is preparing a listing of its Talabat business on the Dubai Financial Market in Q4 2024.

Is Talabat listed company?

A listing may be pursued through a secondary sale of shares by Delivery Hero which would retain the majority interest in the local listing entity after an IPO at Dubai Financial Market.

The execution of an IPO remains subject to market conditions, the approval of a securities prospectus by the Securities and Commodities Authority of the UAE and further resolutions of the Management Board and Supervisory Board of Delivery Hero.

When did Talabat start in dubai?

Talabat began its operations in Dubai in 2012, marking a significant milestone in its expansion beyond Kuwait, where it was founded in 2004 by Abdulaziz Al Loughani and Khaled Al Otaibi. This move into Dubai was crucial in establishing Talabat as a key player in the GCC’s food delivery market. The expansion into Dubai set the stage for its acquisition by Rocket Internet, led by the Samwer brothers—Oliver, Marc, and Alexander Samwer—in 2015. This was followed by Delivery Hero, under the leadership of Niklas Östberg (CEO), acquiring Talabat in 2016 as part of its global strategy.

The company’s Dubai headquarters, inaugurated in January 2023, was a significant development officiated by Sheikh Mansoor bin Mohammed bin Rashid Al Maktoum. The headquarters now serves as a hub for over 2,000 employees, further solidifying Talabat’s importance in the region. Under the leadership of Tomaso Rodriguez, CEO of Talabat since 2019, the company has continued to expand and innovate in the MENA region

Your chance to share your opinion and argue in the comments