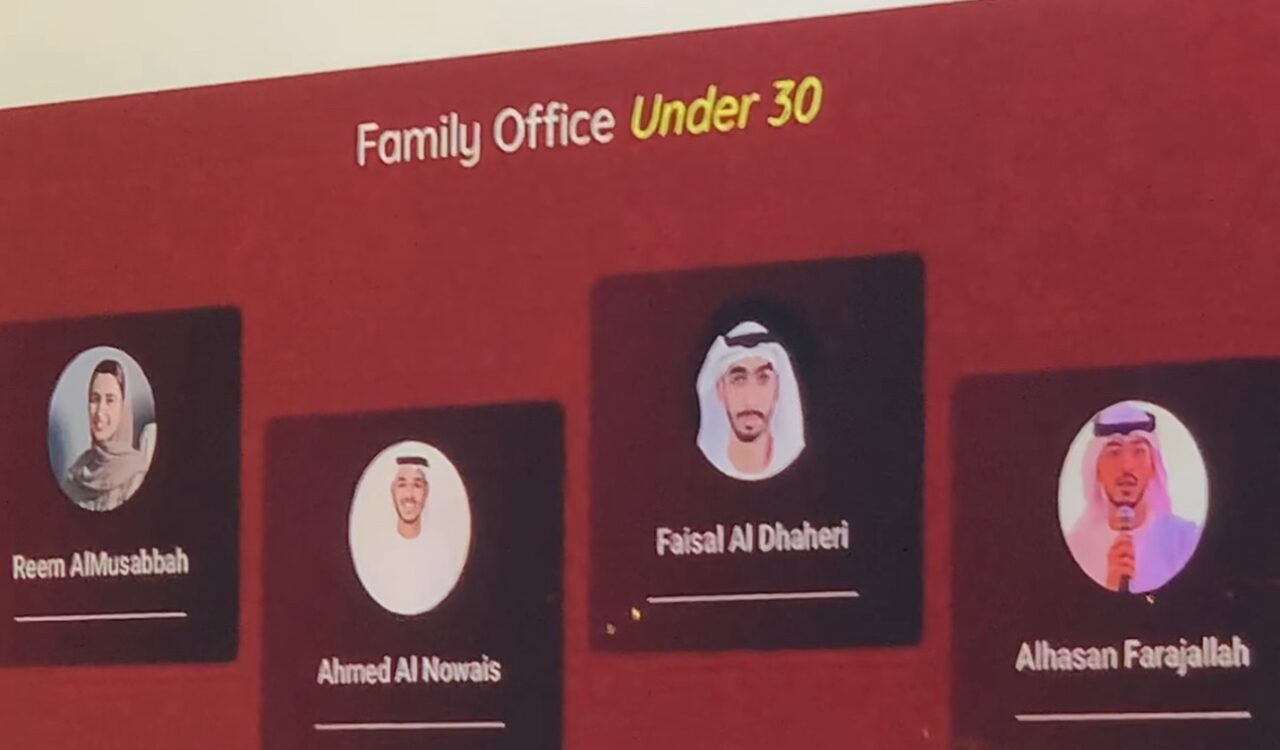

Yours truly, Aleksei Dolgikh as Scout VC, overviewed the 24SIX9 Masterclass of Mr. Obediah Ayton. Family Offices Under 30 participants included Reem AlMusabbah, Ahmed Al Nowais, Faisal Al Dhaheri, and Alhasan Farajallah. How can one catch the attention of family offices from Dubai and Abu Dhabi, Oman, Qatar, Kuwait, Bahrain, Riyadh, Jeddah, Egypt, Pakistan, Turkey, India, China, Luxembourg, and beyond?

Part of the 1 hour 13 minutes Obediah Ayton Family Offices Masterclass 24SIX9:

You wanna!? Your Easy Catching the attention of family offices in these regions requires a multifaceted approach…

• Personalized Outreach: Craft your communication to speak directly to the interests and priorities of each family office. For instance, if a family office is known for investing in tech startups, highlight how your tech solution aligns with their investment strategy. Mention successful case studies and specific metrics that showcase your value. For example:

“Dear Dany Farha, as Co-founder and Managing Partner of BECO Capital, you have a proven track record with investments in companies like Careem and Property Finder. Our AI-driven logistics platform can streamline operations and has already reduced costs by 20% in pilot tests.”

• Build Genuine Relationships: Networking is key. Attend regional industry events like the Abu Dhabi Family Office Summit or the Dubai Investment Forum to meet influential decision-makers. A personal connection can make a huge difference. For example, after attending a session with Fadi Ghandour of Wamda Capital, follow up with a personalized message highlighting mutual interests in supporting tech-enabled startups in the MENA region.

• Leverage Local Partnerships: Form strategic alliances with local businesses and advisors who have established networks within family offices. This can provide you with insider knowledge and introductions that are hard to get on your own. For instance, partnering with a consultant who has connections with Ofir Azury at Gandyr Investments can help navigate the cultural nuances and investment criteria specific to his interests in B2B software and SaaS solutions.

• Show Deep Market Understanding: Demonstrating a thorough understanding of the local economic and cultural landscape can set you apart. For example, knowing the economic drivers in versus Dubai can help tailor your pitch to resonate more with potential investors. Highlight relevant market trends and how your solution fits into the larger economic context of the region.

• Enhance Your Visibility and Credibility: Be active in thought leadership by publishing articles, participating in panels, and maintaining a strong social media presence. Platforms like LinkedIn are great for this. Share your successes and insights to build your reputation. For instance, showcasing a successful exit or a significant milestone in a project can attract attention.

“After leading a successful Series A funding round for our fintech startup, which saw a 50% increase in user acquisition, we believe that our next project aligns perfectly with the investment goals of leaders like Mehmet Selcuk Atici at Earlybird Digital East Fund.”

For Example: Most Active Angel Investors and Key Figures in MENAPT:

• Dany Farha (BECO Capital): Co-founder and Managing Partner of BECO Capital, which has invested in Careem, Property Finder, and many other successful startups .

• Fadi Ghandour (Wamda Capital): Executive Chairman of Wamda Capital, a major player in MENA’s venture capital landscape. Known for investing in Souq.com and Mumzworld .

• Amir Farha (BECO Capital): Co-founder and Managing Partner, instrumental in making BECO Capital a leading early-stage VC firm in the MENA region.

• Yousef Hammad (BECO Capital): Managing Partner at BECO Capital, involved in the strategic direction and investment decisions of the firm.

• Daniel dos Reis (Wamda Capital): Investment Director at Wamda Capital, overseeing the firm’s investment strategy and portfolio management.

• Ofir Azury (Gandyr Investments): Key figure at Gandyr Investments, focusing on B2B software, SaaS, AI, eCommerce, and digital health.

• Mehmet Selcuk Atici (Earlybird Digital East Fund): Investor at Earlybird Digital East Fund, pivotal in tech investments in Eastern Europe and Turkey .

• Abdul Latif Jameel (Family Office): A leading figure in the Abdul Latif Jameel family office, active in various sectors including automotive and renewable energy.

• Suhail Bahwan (Suhail Bahwan Group): Chairman of Suhail Bahwan Group, involved in investments across multiple sectors including real estate, healthcare, and manufacturing.

Let’s Go Back to Obediah Ayton Family Offices Under 30 Masterclass Page Example

1. Reem AlMusabbah:

• Reem is a prominent figure in the Forbes Middle East 30 Under 30 list. She is the founder and CEO of Retech and Esaal, as well as the cofounder and COO of Unipreneur. Her ventures focus on providing digital solutions for startups and enterprises, enhancing retail systems, and fostering youth engagement and development through various events and industry-academia connections.

2. Ahmed Al Nowais:

• Ahmed Nasser Al Nowais is the Founder and CEO of Annex Investments, a hybrid venture family office that supports transformative startups in the MENA region. With over 15 years of experience, Ahmed combines traditional family office strategies with venture capital approaches to support early-stage businesses. He has been instrumental in various ventures such as JustClean and has played significant roles in multiple startups and investment initiatives.

3. Faisal Al Dhaheri:

• Faisal Al Dhaheri is the founder of VUZ, a significant player in the investment and family office sector. He has been active in creating opportunities for partnership, investment, and innovation in the UAE. Faisal’s involvement in family office activities highlights his commitment to driving growth and strategic investments in various sectors.

4. Alhasan Farajallah:

• Alhasan Farajallah is also associated with VUZ, reflecting a strong partnership with Faisal Al Dhaheri.

If you approach them like in the examples, CONGRATULATIONS! Now you know answer to “How to raise money from family office business angels from the regional limited and general partners”…

Your business raised money (if you metrics is good enough) with your truly, Aleksei Dolgikh, by masterclass of Obediah Ayton at 24six9 at in5 Dubai. This pivotal event brought together the brightest minds and most influential investors in the MENA region. With strategic insights and personalized guidance, you successfully secured funding, paving the way for your business’s growth and innovation. The masterclass provided invaluable networking opportunities and a platform to showcase your vision, ultimately leading to this significant milestone. Congratulations on this remarkable achievement and the exciting journey ahead!

Your chance to share your opinion and argue in the comments