The latest “MENA Investor Survey 2022-2023” reveals a resounding optimism among venture capitalists, with 50% of surveyed fund managers already plotting to increase their investments in blockchain infrastructure, metaverse projects, and decentralized finance (DeFi) in the coming year. It’s not just a sign of regional resilience but a global testament to the unstoppable rise of blockchain technology.

MENA Crypto Resilience

Even amidst the turbulence of 2022, global investment capital flowing into the crypto sphere surged past the previous year’s numbers. Reports indicate a staggering $36.1 billion raised in 2022, dwarfing the $30.3 billion of 2021. The MENA region itself saw substantial investment in cryptocurrency and blockchain companies. Notably, RAIN Cryptocurrency Exchange secured a colossal $110 million from MENA investors, including Middle East Venture Partners (MEVP), while BitOasis bagged $30 million from UAE-based Wanda Capital and other prominent entities.

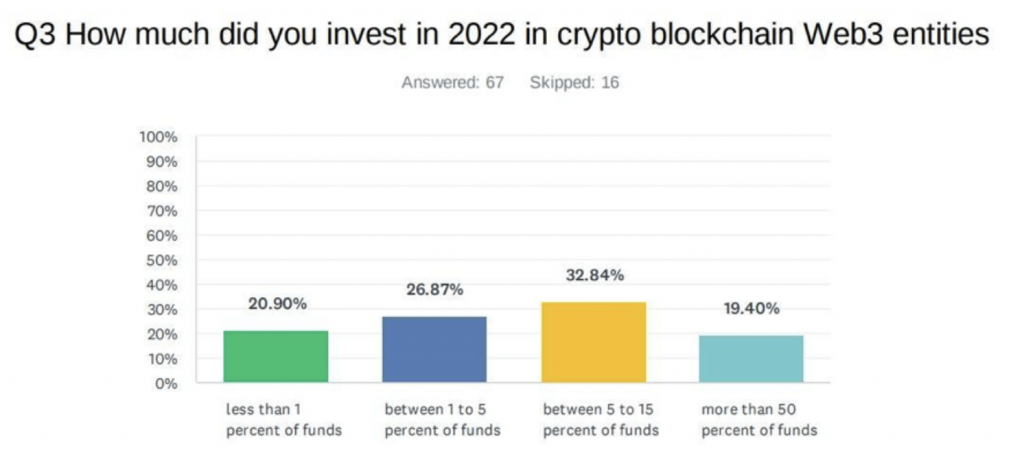

However, the survey’s standout revelation is that 19% of venture capitalists surveyed committed over half of their funds to blockchain businesses in 2022, signaling a deep-rooted belief in the industry’s potential. A remarkable 33% invested between 5-15% of their capital, while 27% allocated 1-5%.

MENA’s Crypto Commitment Persists

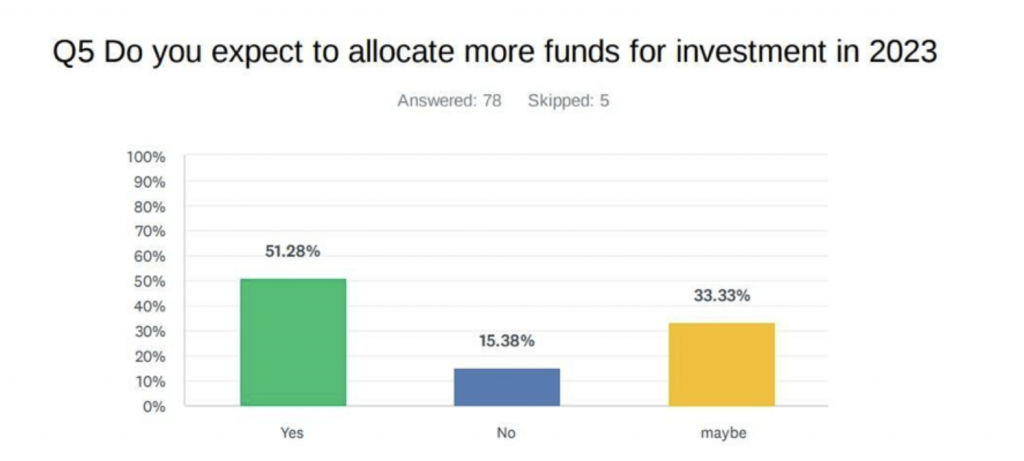

Despite the bearish trend that loomed over the crypto market in 2022, 51% of respondents in the survey boldly affirmed their intention to double down on blockchain and cryptocurrency companies in Future. Only 15% gave a reluctant “no,” while 33% remained undecided. The MENA region’s determination to invest in this space is unwavering.

A Glimpse into the UAE’s Crypto Renaissance

Leading the MENA charge into the crypto future is the United Arab Emirates (UAE), where investors are set to make substantial leaps in cryptocurrency investments. Companies like TradeDog Group’s TD Venture Capital have already taken the initiative with the launch of the Special Mode Fund—a $100 million venture designed specifically for Web 3.0 and blockchain-related assets, breathing fresh life into VCs navigating the volatile token markets.

In December 2022, Cypher Capital, based in the UAE, proudly unveiled a $200 million fund exclusively focused on Web 3.0 infrastructure and middleware investments. Shorooq Partners, in a bold move announced in March 2022, pledged a whopping $150 million for web3 startups. The icing on the cake came in January 2023 when the UAE witnessed the birth of the billion-dollar Venom Ventures Fund, a groundbreaking collaboration between Iceberg Capital and Venom Foundation.

Blockchain and Crypto

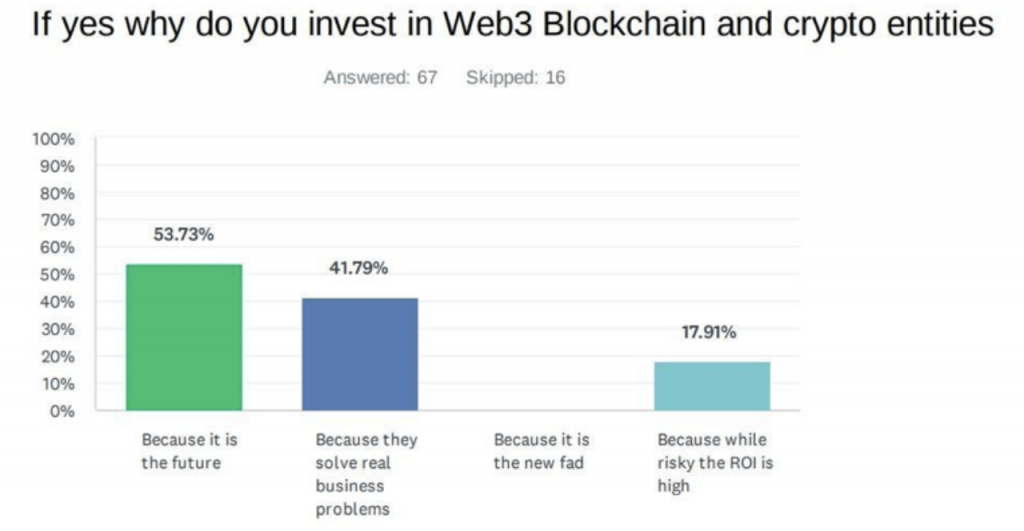

The overwhelming consensus among survey participants, 54% to be exact, is that they invest in cryptocurrency and blockchain entities because these technologies are poised to shape our future. An additional 42% believe in their potential to address the pressing issues of our time. This unshakable belief in the transformative power of blockchain technology underscores the resilience and conviction of MENA investors.

As we look ahead to the Future, MENA region stands at the forefront of the crypto revolution. The Investor Survey paints a compelling picture of venture capitalists with unwavering faith in the potential of blockchain and cryptocurrency. Their determination to increase investments despite market fluctuations is a testament to the enduring allure of this burgeoning sector.

So, if you’re an investor or entrepreneur in the MENA region, now is the time to dive into the crypto and blockchain wave. With visionary fund managers and venture capitalists leading, the stage is set for a transformative year ahead. The future is blockchain, and the MENA region is writing its chapter in this exciting journey. Don’t miss your chance to be a part of it. Join the revolution today!