Beginning of July saw a massive rotation from large caps to small caps in anticipation of looming rate cuts, so much so that the Russell 2000 outperformed Nasdaq by 12 percentage points, something that hasn’t been seen since 2011. According to Bespoke, the Russell 2000 was 4.4 standard deviations , above its 50-day moving average, which was the most overbought any index has been in history. The Russell 2000 rallied over 10% in just four trading sessions.

But the move didn’t last after bad news started trickling in the last week of July (lower than expected payroll increase, ISM manufacturing data that showed contraction, Japanese rate hike and the yen carry trade reversal that followed). The index gave back all those gains and now back almost where it started July.

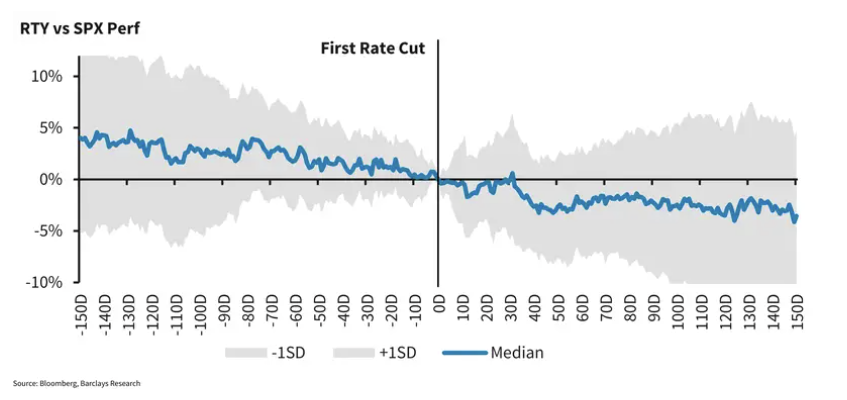

Empirical evidence suggests small caps underperform once the fed starts cutting rates since it usually cuts when the ….. has hit the fan.

Here’s my contra view. If we assume, soft landing sticks ergo US avoids recession and timely rate cuts keep the economy going at a decent base, the rally should broaden to small cap on a sustainable basis. But how much? For this, I have used a metric which my crypto buddy Stephan Roberto taught me (SOL/BTC). I compared VTWO/SPY (Russell 2000/SP500 ETF) and it reveals the ratio of Russell 2000 to SP500 was highest in 2011 and 2014 around 0.25. Recent high was 0.24 in 2021 and it currently stands at 0.15. If I assume SP 500 doesn’t do anything at all from here (5455.21 as of Aug 14, 2024 closing) and Russell has to go back to a 0.24 ratio (2021), it needs to rally 60%.

US stock rally has been largely restricted to Big Tech / Mega Tech / AI / GLP with a few exceptions. If the rally has to broaden out, again, assuming the sticking of a soft landing and additionally, no further broadening out of wars, is a gain like that on an index level imaginable for Russell 2000? After all they are supposed to be the biggest beneficiaries of the rate cuts, since they have a higher debt ratio than SP500 companies. Also, if the economy keeps chugging along, profits will also trickle down to small caps.

Could this time be different?

Thoughts?

Follow for more: