The Middle East and North Africa (MENA) region has long been known for its prowess in industries like FinTech, E-commerce, and Transport and Logistics. However, recent times have witnessed a significant shift in focus towards sustainable ventures. With climate change taking center stage, investors are channeling their capital into sectors that champion sustainability. This transition has led to the emergence of innovative startups in various fields, including renewable energy, waste management, sustainable agriculture, and food tech. Startups like Yellow Door Energy and Pure Harvest in the UAE are disrupting the sustainability landscape. One of the most pressing concerns, food security, has also spurred a surge in investments in the AgriTech sector. In this article, we explore the growth of AgriTech in the MENA region and how it is shaping a more sustainable and food-secure future.

AgriTech’s Soaring Growth in MENA

The MENA region’s AgriTech sector has experienced remarkable growth, attracting over $250 million in funding this year alone. This growth can be attributed to the region’s unique challenges. The arid climate in the Middle East and North Africa necessitates a heavy reliance on food imports, while water scarcity limits traditional agricultural practices. Sustainability concerns have driven the adoption of innovative farming methods and a renewed focus on food security. Startups like Baridi in Sudan and Zr3i.com in Egypt are harnessing the power of artificial intelligence to enhance efficiency, especially for smallholder farmers.

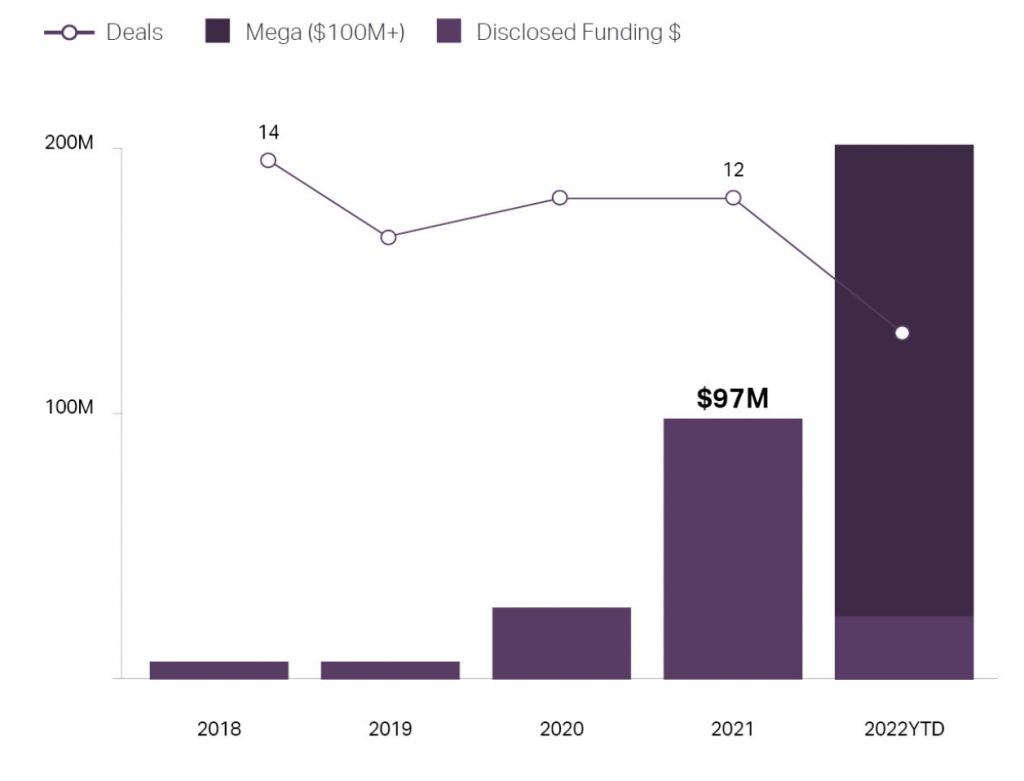

After reaching its peak in 2021, funding in the AgriTech sector has continued to surge in 2022, primarily fueled by Pure Harvest’s impressive $180.5 million funding round. It’s worth noting that while the sector isn’t as capital-intensive as some others, the number of deals in the MENA region has remained consistently high, averaging around 10 deals per year. This steady growth, along with a staggering Compound Annual Growth Rate (CAGR) of 122% from 2018 to 2021, demonstrates the substantial interest from investors. Early Stage deals have been prevalent, and funding in the sector has exhibited a consistent upward trajectory since 2019. The alignment of AgriTech with Sustainable Development Goals (SDGs) makes it an enticing industry for investors looking for both profitability and positive impact.

The MENA Region’s Unique Food Security Challenge

MENA countries face a distinctive food security challenge. As a collective entity, the region boasts the lowest level of food self-sufficiency globally and is the largest food importer, exacerbating its vulnerability to external economic shocks. Additionally, the region grapples with the largest water deficit, further complicating agricultural practices. In the 2022 Global Food Security Index (GFSI), Syria and Yemen ranked among the bottom three countries worldwide. Excluding Gulf Cooperation Council (GCC) countries, the region’s trajectory has been one of worsening food security trends through 2020.

Global challenges, including the Ukraine conflict, the COVID-19 pandemic fallout, and rising inflation, have compounded these pre-existing issues. This has ignited a push to reduce heavy reliance on food imports and subsidies, especially in wealthier GCC nations, where nearly 90% of food products are imported. Local agricultural production is seen as a solution, but the scarcity of water in the region makes it a costly endeavor. Therefore, policymakers are increasingly turning to AgriTech as a means to address food insecurity.

Agritech Takes Off in MENA, Led by Saudi Arabia and the UAE

Agritech revolves around developing technologies that enhance agricultural productivity. This encompasses innovations like new seed varieties, AI and robotics for increased crop yields, and drones for crop monitoring and management. Advances in AI and expanded computing capabilities have laid the groundwork for AgriTech to play a pivotal role in ensuring resilient food systems. Globally, Agritech companies have witnessed substantial growth, and this trend is now taking root in the MENA region.

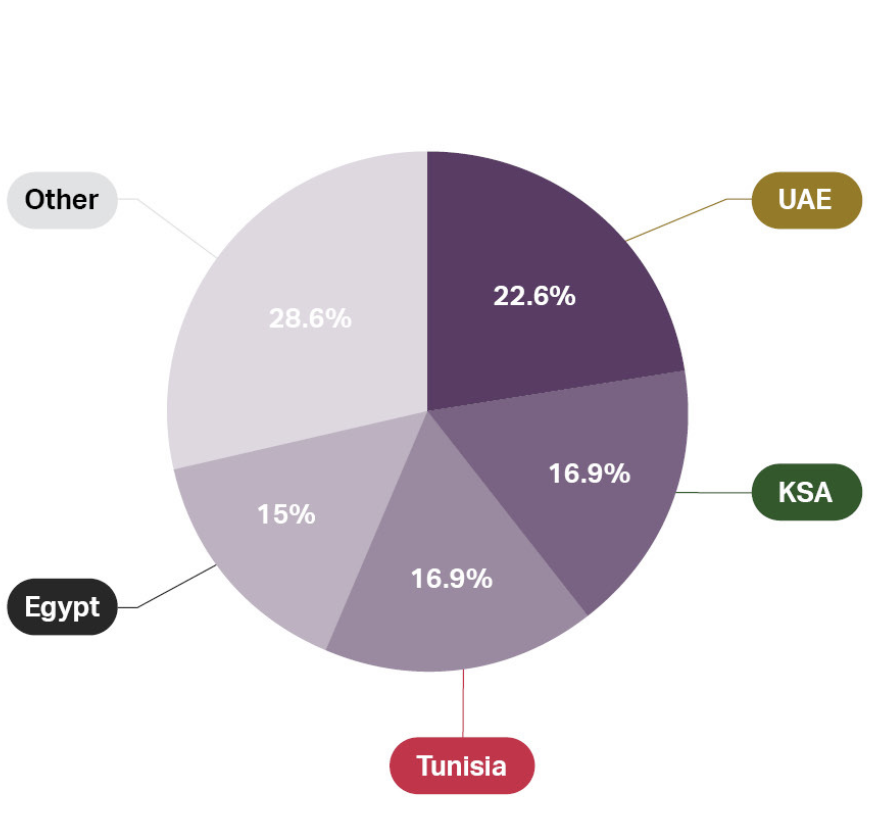

The volume of Agritech investments in MENA experienced a remarkable Compound Annual Growth Rate (CAGR) of 122% from 2018 to 2021. Funding in the sector has been rapidly increasing since 2020, and in 2022, aggregated funding across the MENA region surpassed $250 million, up from $97 million in 2021. While Agritech venture capital in MENA remains relatively small compared to other regions, investments in the region accounted for 4% of global Agritech investments in 2022, up from just 1% in 2021.

Saudi Arabia and the UAE are at the forefront of developing Agritech in the region. In Riyadh, a blend of public and private partnerships is driving investments in Agritech innovations, aligning with Saudi Arabia’s Vision 2030 plan. For example, Wa’ed, the venture capital arm of Saudi Aramco, invested $18.5 million in the Saudi Agritech startup Red Sea Farms, which specializes in growing produce in water-scarce environments. In the UAE, the government is making substantial investments in Agritech companies, focusing on reducing imports through practices like vertical farming, hydroponics, and technology to track harvests. The Abu Dhabi Investment Office (ADIO) established a $200 million fund to invest in early-stage companies, with a significant uptick in investment in 2022.

Agritech companies have adapted to the specific needs of individual nations, leading to growth across the region. In Egypt, for instance, smartphone apps are being used to assist farmers by providing access to microfinance, aiding in the purchase of agriculture products, and connecting farmers with storage facilities to reduce storage costs. This low-tech approach is proving successful across the MENA region.

Challenges and Opportunities

Despite the impressive growth of Agritech, significant challenges remain. Many MENA countries face barriers to access, including limited access to digital technology and data, inadequate financial resources and supporting infrastructure, and a lack of policies promoting Agritech innovation. While some nations like the UAE and Kuwait have better access to digital technology, others like Yemen and Lebanon lag behind, hindering widespread innovation. Over time, humanitarian aid and Foreign Direct Investment (FDI) can help bridge this gap.

Data plays a pivotal role in the success of Agritech companies, enabling data-backed strategies for efficient crop growth. To support Agritech startups, governments must invest in data collection, sharing, and policies that ensure data privacy and security while allowing for commercial use. However, agricultural data remains scarce in the MENA region, often due to inconsistent collection methods and government regulations.

Access to financing is another significant barrier to Agritech development. Many startups in the region are small and lack the resources for research and development. Some are not yet profitable and require funding to scale their operations. Regional governments can play a crucial role by enacting policies to support startups or providing direct grants and investments.

A Path to Sustainable Food Security

Agritech is poised to play a pivotal role in transforming the MENA region’s food security landscape. As countries grapple with pressing food security challenges, technology-driven innovations offer a glimmer of hope. Agritech has already begun reducing reliance on food imports and enabling more sustainable water usage. For this sector to thrive, governments must continue investing in technology, implementing policies that support innovation, and fostering collaboration among countries with varying income levels. While technology alone may not be the sole answer to food insecurity, when integrated into a comprehensive strategy, it becomes a critical contributor to building more resilient food systems in the MENA region.

Investors and entrepreneurs are recognizing the immense potential of Agritech in addressing food security concerns while promoting sustainability. The MENA region’s journey toward a more secure and sustainable food future has only just begun, and Agritech is leading the way. In the coming years, we can expect to see even more exciting developments and innovations in this dynamic sector.