Dubai Secrets of “How to Raise $400K in 15 Minutes?” covered by Teleporta Founder Alexander Bychkov interview the Dan Gudkov .dodocs ai CEO and Founder of Intelligent Processes Automation with 50xROI, Applied AI, 6th time founder who achieved $500k MRR in 1 month.

Article International Search Engine Optimization Sponsor the . Add G to You Local Business! Thanks for Chinese, Russian, German, French, English optimized versions:

The Entrepreneurial Journey of Dodocs

Seizing Opportunity

Dan Gudkov starts by explaining how responding to just a few replies led to significant opportunities. He emphasizes the importance of persistence and seizing every potential connection, regardless of its initial size. .

A Transformative Meeting

A brief, 15-minute meeting was pivotal. Dan shares how this short meeting led to a rapid funding round, underscoring the efficiency and impact of being prepared and direct. .

Leveraging Big Tech Partnerships

Dan highlights the importance of strategic partnerships. Being part of Nvidia Inception and Microsoft for Startups helped Dodocs not only gain credibility but also close significant revenue, illustrating the value of aligning with established players in the industry. .

Crafting the Pitch and Securing Early Investments

Crafting an Effective Pitch

In this segment, Dan Gudkov shares his experience preparing for the key meeting that led to securing funding. He emphasizes the importance of clarity and brevity in presentations, detailing how he used a one-pager and several quotes to capture the essence of his business model. .

Delivering the Pitch

Dan discusses the actual presentation and interaction during the crucial 15-minute meeting. He highlights the significance of direct communication and engaging potential investors quickly, which proved pivotal in securing their interest and eventual funding. .

Immediate Aftermath and Lessons

Post-meeting, Dan reflects on the outcomes and the effectiveness of his approach. He shares insights on what worked in the presentation and discusses how startups can learn from his experience to enhance their own fundraising strategies. .

Navigating Challenges and Scaling Innovatively in Dubai Internet City

Strategies for Handling Rapid Growth

In this segment, Dan discusses how Dodocs handled the rapid growth following their successful funding. He delves into the operational challenges and strategic decisions essential for managing scale while maintaining service quality. .

Evolving the Product to Meet Market Needs

Dan elaborates on the iterative improvements made to Dodocs’ product offerings to better serve an expanding customer base. This includes integrating user feedback into product development to ensure relevance and competitiveness. .

Sustaining Innovation and Market Leadership

Focusing on sustaining innovation, Dan shares insights on how Dodocs continued to innovate in their offerings to stay ahead of market trends and competitor moves. He also discusses strategies for maintaining market leadership through continuous innovation and agile methodologies. .

Mastering the Art of Pitching and Networking

Perfecting the Pitch

Dan discusses how he refined his pitching skills, emphasizing the importance of clarity and impact in a short time frame to capture investor interest. He elaborates on the techniques that helped him successfully communicate the value proposition of Dodocs quickly and effectively. .

Leveraging Networking at Conferences

Networking played a crucial role in Dodocs’ early funding success. Dan shares his strategies for effective networking at conferences, including how to identify and approach potential investors, and how to follow up after initial contacts. .

The Impact of Strong Presentation Skills

Dan highlights the critical role of strong presentation skills in securing funding. He provides insights into creating compelling presentations that engage and persuade investors, drawing on his own experiences of what has worked in investor meetings. .

Strategic Growth and Future Plans

Enhancing Core Technologies

Dan discusses the continuous enhancement of Dodocs’ core technologies. He emphasizes the importance of staying ahead in technology to maintain a competitive edge, particularly in AI and machine learning applications within their platform. .

Expanding Market Reach

Dan outlines strategies for geographic and sectoral expansion. He highlights the importance of understanding diverse market needs and adapting products accordingly to ensure successful market penetration and customer retention. .

Vision for the Future

In the final segment, Dan shares his vision for the future of Dodocs, focusing on innovation, sustainability, and global impact. He discusses plans for integrating emerging technologies and expanding into new markets to ensure long-term success and influence. .

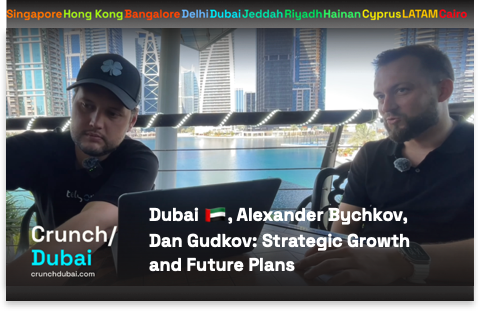

The text in the center of the image reads: “He raised $400K for his AI startup after a 15 minutes meeting in Dubai.” Above the men, there is a small image of a flag and the word “Step Conference,” indicating the event where the meeting took place.

The top border of the image lists various major cities in orange text, suggesting a global reach of Crunch: Singapore, Hong Kong, Bangalore, Delhi, Dubai, Jeddah, Riyadh, Hainan, Cyprus, LATAM, Cairo.

Overall, the image emphasizes a remarkable fundraising achievement in a short time at a significant business conference in Dubai.

$400K in 15 Minutes at a STEP Conference in Dubai, UAE 2024 Full Video With Alexander Bychkov and Dan Gudkov About

How to Make a Successful Pitch to Investors?

Creating a successful pitch to investors hinges on demonstrating a clear understanding of your startup’s value proposition, market potential, and the team’s capability in a succinct manner. Start by articulating the problem your business solves, like reducing food waste through a mobile app that connects restaurants with local food banks, and follow up with your solution to underline the market opportunity. Highlight your business model, emphasizing revenue streams such as subscription fees and transaction fees, and showcase existing traction, like achieving a Monthly Recurring Revenue (MRR) of $20,000 or an Annual Recurring Revenue (ARR) of $240,000. Your team’s expertise and skills should be presented as a crucial component of your potential success, emphasizing their background and relevance to the venture’s goals.

As your startup progresses through funding stages, tailor your pitch to reflect the increased sophistication and growth of your company. In the pre-seed stage, focus on product development and market research with valuations typically ranging from $1M to $3M, and seek to raise about $250,000 to $500,000. By the seed stage, where valuations are between $3M and $6M, investors expect to see market entry and initial traction, with funding goals around $1M to $2M. For Series A, you should demonstrate significant user growth and scaling operations, aiming for valuations between $10M and $30M and raising funds in the realm of $3M to $10M. By Series B, with valuations soaring to $30M – $100M, your company should showcase clear market leadership and expansion plans, targeting fundraising of $10M to $50M. Each pitch at these stages should include robust financial projections, strategic plans that align with these valuation expectations, and clear evidence of MRR and ARR growth, ensuring you communicate your startup’s growth trajectory and readiness for substantial investment effectively.

What Are Effective Strategies for Networking at Business Conferences?

Networking at business conferences is an art that, when done effectively, can significantly boost your startup’s funding and growth prospects. Begin by doing your homework on the attendees; identify key figures such as Limited Partners (LPs), General Partners (GPs), and various levels of fund managers. Understanding their investment focus—whether it be Venture Studios known for seed funding ranging from $50,000 to $500,000, Corporate Venture Capitals interested in strategic investments from $500,000 to $5 million, or LPs typically investing in larger funds of $10 million and above—can tailor your approach for more engaging conversations.

For your pitch, make it concise and compelling, clearly aligning your startup’s objectives with the financial interests and strategies of the individuals you aim to connect with. For instance, when speaking with Venture Capital Fund Managers, emphasize potential for rapid growth and scalability that could justify investments typically in the $2 million to $10 million range. For Private Equity Fund Managers, who often manage funds exceeding $100 million and seek stable, revenue-generating companies, highlight your company’s steady cash flows and strong market position. Similarly, Multi Family Office Fund Managers, overseeing diversified portfolios that include direct startup investments, are attracted to long-term value and stability, appealing to their investment strategies that often involve multi-million dollar commitments.

At the conference, craft an elevator pitch tailored to each type of investor—highlighting innovative potential to Venture Capital Fund Managers, strategic alignment to Corporate Venture Capitals, and robust revenue models to Private Equity Fund Managers. Engage by asking insightful questions that show your understanding of their challenges and investment criteria, establishing a connection that paves the way for a follow-up.

After the event, send personalized follow-up communications referencing specific points from your conversations, offering detailed updates on your startup’s progress and reiterating how it aligns with their investment goals. Regular updates help keep your business in their consideration for future funding rounds or strategic partnerships. By strategically engaging with these key figures and maintaining ongoing communication, you can significantly enhance your networking effectiveness, potentially leading to lucrative opportunities and vital industry connections.