Introduction

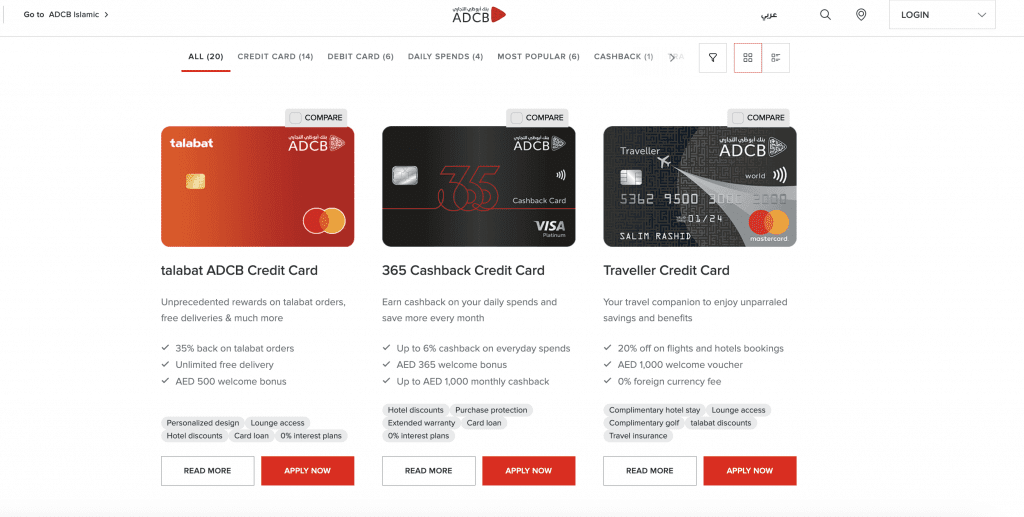

In today’s fast-paced world, having a reliable and rewarding credit card is essential for managing your finances and enjoying a variety of perks. , a top-tier financial institution in the United Arab Emirates, offers a wide range of credit cards designed to cater to the diverse needs and lifestyles of its customers. Whether you’re a frequent traveler, an avid shopper, or simply looking for a convenient way to manage your expenses, ADCB has the perfect credit card solution for you.

Flexibility and Rewards

One of the most significant advantages of an is the unparalleled flexibility it offers. With an extensive array of cards to choose from, you can easily find one that perfectly complements your lifestyle, spending patterns, and financial aspirations. For example, if you’re a frequent jet-setter, the is an ideal choice.

This card comes with an impressive suite of travel benefits, including air miles that can be redeemed for flights and upgrades, complimentary airport lounge access to make your travels more comfortable, and comprehensive travel insurance to give you peace of mind while you explore the world. On the other hand, if you’re a shopping enthusiast who loves to earn rewards on your daily purchases, the ADCB Touchpoints Credit Card is the perfect match. With this card, you can accrue reward points on every transaction, from grocery shopping to filling up your tank at the gas station. These points can later be redeemed for an extensive selection of products and services, such as electronics, home appliances, dining experiences, and even charitable donations, allowing you to indulge in the things you love while getting more value from your spending.

Convenience and Security

Apart from its flexibility, an ADCB credit card also offers unparalleled convenience. Say goodbye to the hassle of carrying large sums of cash or worrying about insufficient funds during emergencies. With an ADCB credit card, you can make purchases online and in-store effortlessly, knowing that you have a dependable payment method at your disposal. Furthermore, ADCB credit cards are fortified with advanced security features, such as chip and PIN technology, ensuring that your transactions are always safe and secure, providing you with peace of mind whenever you use your card.

Eligibility Criteria

To apply for an ADCB credit card, there are a few crucial requirements that you must fulfill:

The applicant must be at least 21 years old.

The applicant should meet the salary requirements based on their chosen ADCB credit card.

A good credit score is essential to avail of any credit card.

The applicant must have a valid UAE mobile number.

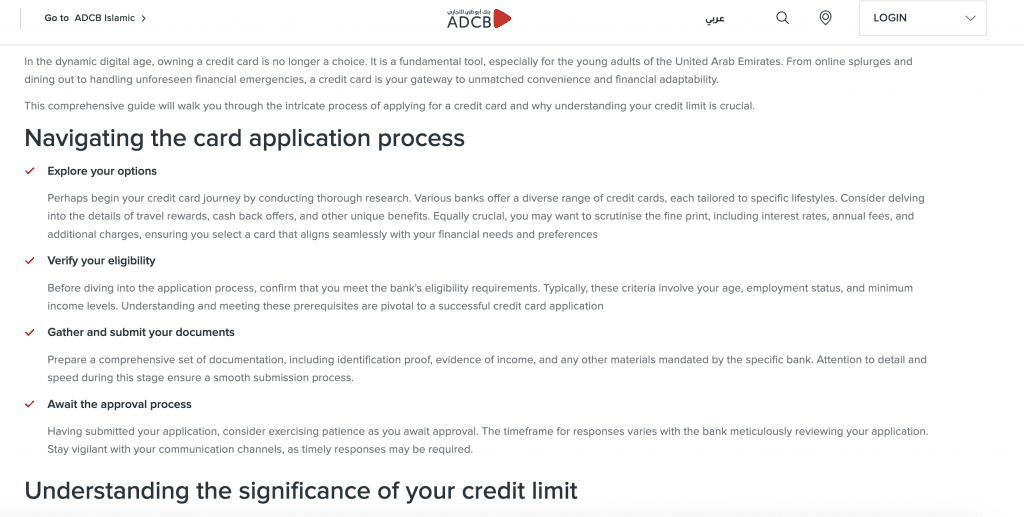

Application Process

Applying for an ADCB credit card is a simple and hassle-free process, designed to ensure that you can start enjoying the benefits of your card as soon as possible. The first step is to visit the ADCB website or one of the bank’s branches to access the credit card application form. You can choose to complete the application online for added convenience or fill out a physical form at the branch if you prefer a more personalized experience. The application form will require you to provide various personal and financial details, such as your full name, contact information, employment status, monthly income, and existing financial commitments. It’s essential to fill out the form accurately and completely to avoid any delays in processing your application. In addition to the completed form, you’ll also need to submit a few supporting documents to verify your identity and financial status.

These typically include a copy of your Emirates ID, your passport, and your latest salary certificate or bank statement. Once you’ve gathered all the necessary documents and completed the application form, simply submit them to ADCB through the website or at your nearest branch. The bank’s credit card team will then review your application and conduct the necessary credit checks to determine your eligibility. If your application is approved, you’ll receive your new ADCB credit card within a few days, along with a welcome pack containing all the information you need to start using your card and enjoying its many benefits.

Account Management

Once your application is approved, you can start using your ADCB credit card right away. Managing your account is effortless, thanks to the ADCB internet banking portal and mobile app. These digital platforms allow you to view your transactions, pay your bills, and redeem your rewards points anytime, anywhere, giving you complete control over your financial life.

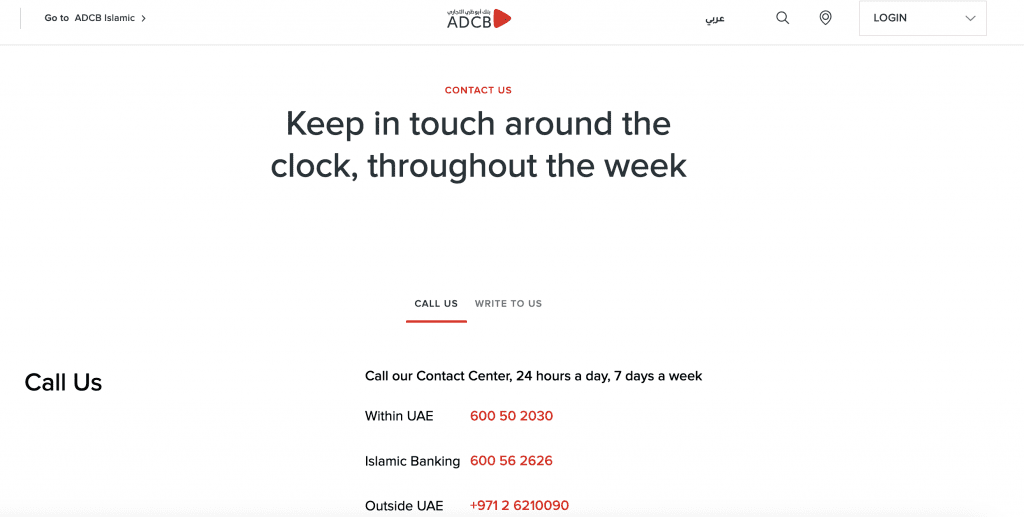

Customer Support

One of the most significant benefits of being an ADCB credit card holder is the exceptional customer support that comes with it. The ADCB customer service team is available 24/7 to assist you with any queries, concerns, or issues you may encounter regarding your credit card. Whether you need help with a transaction, want to report a lost or stolen card, or simply have a question about your rewards points, the ADCB team is always ready to provide prompt and professional assistance, ensuring that your credit card experience is always smooth and stress-free.

Exclusive Privileges

Moreover, ADCB credit cards offer a host of exclusive privileges and discounts that can help you save money and enhance your lifestyle. From dining deals at top restaurants to discounted hotel stays and special offers at leading retailers, your ADCB credit card opens up a world of possibilities, allowing you to indulge in the finer things in life without breaking the bank.

Read more on CrunchDubai:

Conclusion

In summary, an ADCB credit card is more than just a financial tool; it is a gateway to a world of unrivaled benefits, convenience, and financial freedom. With its flexible options, advanced security features, exceptional customer support, and exclusive privileges, an ADCB credit card is the perfect companion for anyone looking to simplify their financial life, enjoy life’s pleasures, and achieve their goals. If you’re ready to take control of your finances and experience the many advantages that an ADCB credit card has to offer, visit the ADCB website or contact the bank’s customer service team today to learn more and embark on your journey towards financial empowerment.

Vasilii Zakharov

With an ADCB credit card, you don’t just get a piece of plastic: You open the door to a world of convenience and rewards. From hassle-free transactions to exclusive benefits, this card is your key to an enhanced banking experience. The application is easy, and the benefits are endless. Don’t miss this opportunity to simplify your financial life and enjoy the additions that come with it!